Fixed income investors are

continually looking for high yielding investments with stability of principal.

It has been that way for decades. Today is no different either. For years, the

high yield bond market provided more than ample income for investors and in

some cases capital appreciation of their investment. That has all changed over

the past year.

continually looking for high yielding investments with stability of principal.

It has been that way for decades. Today is no different either. For years, the

high yield bond market provided more than ample income for investors and in

some cases capital appreciation of their investment. That has all changed over

the past year.

Share prices of high yield

bond ETF’s have declined on average -15.33% over the past year while yields

have remained stable or increased in some cases due to price declines. Some

investors face another problem, where can they re-invest surplus income. Both

situations are very troubling for fixed income investors today.

bond ETF’s have declined on average -15.33% over the past year while yields

have remained stable or increased in some cases due to price declines. Some

investors face another problem, where can they re-invest surplus income. Both

situations are very troubling for fixed income investors today.

Since the beginning of the

year investors have seen extremely high market volatility for a plethora of

reasons which we will not go into here. Despite all the hoopla in the news and

talk by pundits, fixed income investors questions have not changed. They remain

the same and they need answers.

year investors have seen extremely high market volatility for a plethora of

reasons which we will not go into here. Despite all the hoopla in the news and

talk by pundits, fixed income investors questions have not changed. They remain

the same and they need answers.

Today, I am going to share an

idea which may address the fixed income investors questions. This is a little

known area to many investors. It is called Exchange Traded Debt (ETD’s or Baby

Bonds). They trade on the stock exchange like a stock, but they are actually

debt of corporations.

idea which may address the fixed income investors questions. This is a little

known area to many investors. It is called Exchange Traded Debt (ETD’s or Baby

Bonds). They trade on the stock exchange like a stock, but they are actually

debt of corporations.

ETD’s or Baby Bonds are debt

issued by a corporation in denominations less than the normal bond denomination

of $1,000. In fact, most ETD’s are issued in $25.00 denominations. They all pay interest, usually quarterly,

unlike most bonds which pay semi-annually. There is no preferential tax

treatment on the interest paid.

issued by a corporation in denominations less than the normal bond denomination

of $1,000. In fact, most ETD’s are issued in $25.00 denominations. They all pay interest, usually quarterly,

unlike most bonds which pay semi-annually. There is no preferential tax

treatment on the interest paid.

Now, let’s look at

what happened over the past year (2/13/15- 2/12/16). Below are a few

interesting data points which support why investors may want to consider ETD’s

as an income alternative. Before we look at that data, keep in mind the ETD’s

selected are all investment grade securities vs. high yield bonds which are non-investment grade.

High Yield ETF’s * IG – ETD’s **

Average

Change in Principal/ Price Only -15.33% -2.83%

Change in Principal/ Price Only -15.33% -2.83%

Average

Current Yield

6.91% 6.38%

Current Yield

6.91% 6.38%

Standard

Deviation

5.71 2.15

Deviation

5.71 2.15

Ok, this all sounds great, but

what is the down side? The downsides are the spreads are a little wider than

one would expect. So, you do not want to use market orders when buying or

selling. Limit orders only. Next, you are investing in individual issues, so

you do not have the diversification of a ETF.

what is the down side? The downsides are the spreads are a little wider than

one would expect. So, you do not want to use market orders when buying or

selling. Limit orders only. Next, you are investing in individual issues, so

you do not have the diversification of a ETF.

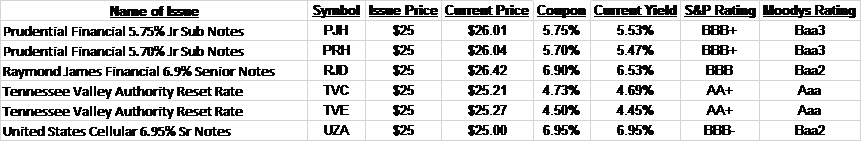

The key to investing in ETD’s

is to focus on investment grade issues. Investment Grade ETD’s carry a lower

default risk, yet they provide yields equal to high yield bonds. Below is a

sample of investment grade ETD’s. You see issuers like Prudential Financial,

U.S. Cellular, Tennessee Valley Authority and even Raymond James Financial.

Some ETD issues are even secured with real estate.

is to focus on investment grade issues. Investment Grade ETD’s carry a lower

default risk, yet they provide yields equal to high yield bonds. Below is a

sample of investment grade ETD’s. You see issuers like Prudential Financial,

U.S. Cellular, Tennessee Valley Authority and even Raymond James Financial.

Some ETD issues are even secured with real estate.

One last point here. In the

event of a corporate bankruptcy, bond holders (ETD’s) are in line ahead of

preferred and common stock investors. A small nuance, but something to consider.

I say this because some investors confuse ETD’s with preferred stocks. ETD’s

are not stocks, they are debt and pay interest. They just trade on the stock

exchange like a preferred stock or high yield ETF.

event of a corporate bankruptcy, bond holders (ETD’s) are in line ahead of

preferred and common stock investors. A small nuance, but something to consider.

I say this because some investors confuse ETD’s with preferred stocks. ETD’s

are not stocks, they are debt and pay interest. They just trade on the stock

exchange like a preferred stock or high yield ETF.

Notes:

* Data

compiled from a Composite of the 10 Largest High Yield ETF’s.

compiled from a Composite of the 10 Largest High Yield ETF’s.

** Data

compiled from a Composite of 40 Investment Grade ETD’s.

compiled from a Composite of 40 Investment Grade ETD’s.