Hello Everyone,

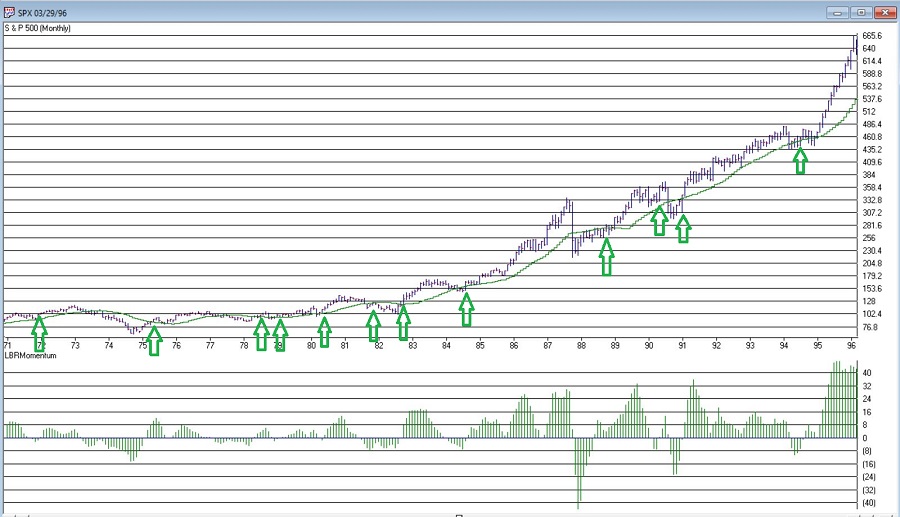

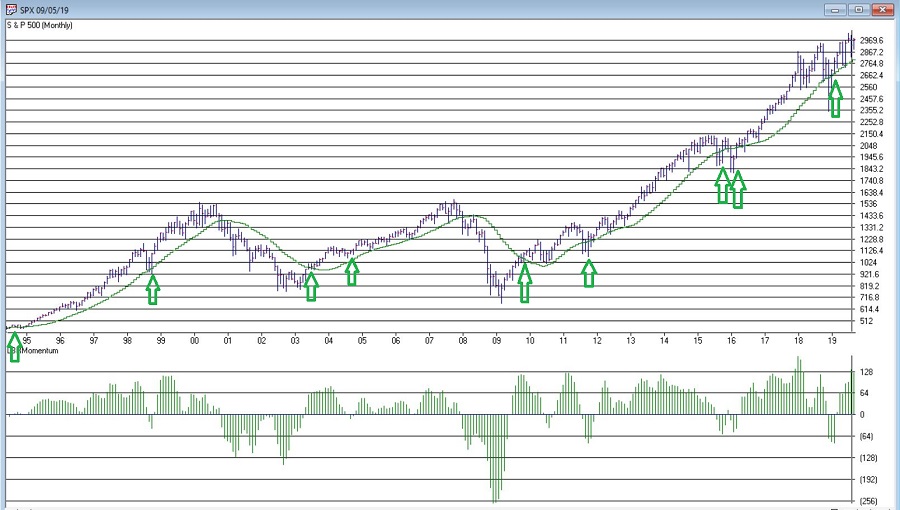

Over the last month the S&P 500 has risen 3% and is about 2/3rds of 1% below its high it reached in July. Last month on the Bartometer I stated that my computer models were on a Short term Buy signal and the S&P needed to break out of 2944- 2954 for me to be more bullish. I also said that if the S&P stayed above 2954 for 2 days it should head back to the old high of 3025 or there about and it did. Now that the markets are near their old high, where do I think the markets will go? Well, the answer isn’t so easy to answer. Technically the markets are overbought again but two of the technical indicators that show continuation on are On Balance Volume and Money Flow. Both of these indicators are currently at a New High, when the markets are not. These indicators while not always indicative of further advancement are still positive for a continuation to the upside. See the charts below.

My fundamental economist Dr. Robert Genetski, from ClassicalPrinciples.com said last week’s move by the European Central Bank (ECB) to ease policy is good news for the period immediately ahead. The ECB cut its target interest rate and will indefinitely purchase $20 billion of securities each month beginning in November. The move pressures the Fed and other central banks to also ease policy. Negotiations with China also appear to be moving in a positive direction. China is suffering much more than the US from Trump’s tariffs. China is anxious to reach a deal to avoid further problems. On Wednesday the Fed will follow the ECB and the Bank of Japan (BOJ) by cutting interest rates. Unlike the ECB and BOJ, the Fed will not resume purchases of securities. Hence, the Fed will not be easing policy. However, the perception of a period of global easing is likely to provide a short-term tailwind for boosting stocks and interest rates. Over the past 2 weeks there has been a 30 basis point increase in the yield on 10-year T-Notes. This has narrowed the inversion with 3-month Treasury bills from 50 basis points to 20. The spike in rates means financial markets reflect the view that monetary policy is less restrictive. This view is reinforced by the actions of the EC.

On the Technical Side

My computer models went on a very short term BUY signal 5 weeks ago when the S&P was 2844 and has not gone to a Sell signal, but there needs to now be a push through the 3027 level on the S&P and stay there or there could be a sell off here. Two of my favorite indicators Money Flow and On Balance Volume are at a new high while the index is not. This is a positive indication for continuation on the upside. But remember, we still need to watch all of the information that is coming out of the mouth of all political figures and the global markets, but currently I am still moderately bullish. I never put my guard down. See chart below

Interest Outlook

I see the Federal Reserve reducing interest rates ¼% in December.

Some of the INDEXES of the markets both equities and interest rates are below. The source is Morningstar.com up until September 13th, 2019.

These are passive indexes.

*Dow Jones +18%

S&P 500 +21%

NASDAQ Aggressive growth +25%

I Shares Russell 2000 ETF (IWM) Small cap +18%

International Index (MSCI – EAFE ex USA) +13%

Moderate Mutual Fund +12%

Investment Grade Bonds (AAA) +11% +2.64%

High Yield Merrill Lynch High Yield Index +9% +4.26%

Floating Rate Bond Index +5% +2.60%

Short Term Bond +3%

Fixed Bond Yields (10 year) +1.82.% +2.63%

The average Moderate Fund is up 12% this year fully invested as a 60% in stocks and 40% in bonds. And nothing in the money market

*Explanation of each below

The Dow Jones Index is above. As it contains 30 of the largest industrial and American stocks. You will notice that the Dow above and to the right is approaching its old high achieved in July. It has rallied 5% since the Buy signal my computer models gave last month. But now it has to break out to new highs or it puts in a double top. There are 3 indicators above that are important. The first one is SK-SD Stochastics and it is back to the 88 level and that shows the market is overbought. The 2nd and third are Money Flow and On Balance Volume. Both of those indicators are very important for me to determine confirmation and continuation of the rally. Notice that both of them are at a new high while the Dow Jones is not. This is a positive divergence and hopefully the markets will continue its upward movement. I like the USA markets more than the International markets. The Dow Jones looks better than the S&P and the NASDAQ technically at this time. Remember, volatility will still be present so I would still be somewhat cautious.

Source: AIQ Systems on graphs

*On-balance volume (OBV) is a technical analysis indicator intended to relate price and volume in the stock market.

OBV is based on a cumulative total volume.[1]

*Money flow is calculated by averaging the high, low and closing prices, and multiplying by the daily volume. Comparing that result with the number for the previous day tells traders whether money flow was positive or negative for the current day. Positive money flow indicates that prices are likely to move higher, while negative money flow suggests prices are about to fall.

Source: Investopedia

*A Support or support level is the level at which buyers tend to purchase or into a stock or index. It refers to the stock share price that a company or index should hold and start to rise. When a price of the stock falls towards its support level, the support level holds and is confirmed, or the stock continues to decline, and the support level must change.

- Support levels on the S&P 500 area are 2954.71, 2950, 2944, and 2931. These might be BUY areas.

- Support levels on the NASDAQ are 8024, 7969, and 7777 (200 Day Moving Average.

- On the Dow Jones support is at 26,766, 26,595, and 26,368

- These may be safer areas to get into the equity markets on support levels slowly.

- RESISTANCE LEVEL ON THE S&P 500 IS 3028. If there is a favorable tariff settlement, the market should rise short term.

THE BOTTOM LINE:

The Dow, the S&P 500 and the NASDAQ are all near new highs. 5 weeks ago on the Bartometer my computer models went to a Buy signal. Since then, the markets have rallied near their old highs. There are technical patterns that show the markets could breakout to new highs but IF THE MARKETS DON’T BREAKOUT OUT SOON, THE MARKETS COULD TOP OUT. I WILL CONTINUE TO ANALYZE THE TECHNICALs OF THE MARKET. There are seasonal patterns that are usually week. September and October ARE NOT SEASONALLY GOOD MONTHS. It looks like the market wants to goes up but with tweets coming out hourly, market timing will be more difficult. If things come in as Trump expects, watch for a solid rally possibly to the old highs. But there are headwinds currently short term.

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

5 Colby Way

Avon, CT 06001

860-940-7020 or 860-404-0408

SECURITIES AND ADVISORY SERVICES OFFERED THROUGH SAGE POINT FINANCIAL INC., MEMBER FINRA/SIPC, AND SEC-REGISTERED INVESTMENT ADVISOR.

Charts provided by AIQ Systems:

Technical Analysis is based on a study of historical price movements and past trend patterns. There is no assurance that these market changes or trends can or will be duplicated shortly. It logically follows that historical precedent does not guarantee future results. Conclusions expressed in the Technical Analysis section are personal opinions: and may not be construed as recommendations to buy or sell anything.

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, and SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values. It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30- 50% of its portfolio indifferent categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment grade rating.

The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating rate coupon U.S. Treasuries which have a maturity greater than 12 months.