AIQ explore list is a powerful and very fast method to view many charts quickly. In this video Steve explores daily and weekly charts simultaneously looking for MACD divergences and double top and bottoms.

Category Archives: technical indicator

Weekly & Daily Stochastics

The AIQ code based on Vitali Apirine’s article in the September issue of Stocks and Commodities, “Weekly and Daily Stochastics, is provided below

Using Apirine’s weekly and daily stochastic indicators and a moving average to determine trend direction, I created an example system (long only) with the following rules:

Enter long next bar at open when all of the following are true:

- The 200-day simple average of the NDX is greater than the day before

- The 200-day simple average of the stock is greater than the day before

- Both the weekly and daily stochastic indicators have been below 20 in the last five days

- Both the weekly and daily stochastic indicators are greater than the day before.

I tested three exits. Figure 8 shows a 21-day hold then exit. Figure 9 shows a three-moving-average trend-following exit. Figure 10 shows an exit using only the weekly & daily stochastic, once both are lower than the day before.

FIGURE 8: AIQ, BUY and HOLD. Here is the sample equity curve (blue) compared to the NDX (red) for the test using a 21-day hold exit.

FIGURE 9: AIQ, TREND-FOLLOWING EXIT. Here is the sample equity curve (blue) compared to the NDX index (red) for the test using a trend-following exit.

FIGURE 10: AIQ, W and D STOCHASTIC EXIT. Here is the sample equity curve (blue) compared to the NDX index (red) for the test using the weekly and daily stochastic indicators.

The 21-day hold test showed a 11.2% return with a maximum drawdown of 29.3%. The trend-following exit test showed a 17.6% return with a maximum drawdown of 28.8%. The test using an exit based on only the weekly and daily stochastic indicators showed a return of 2.9% with a maximum drawdown of 32.5%. All the tests used the same entry rule and were run on an old 2016 list of the NASDAQ 100 stocks with the stocks that are no longer trading deleted.

!WEEKLY AND DAILY STOCHASTIC

!Author: Vitali Apirine, TASC Sept 2018

!Coded by: Richard Denning 7/7/2018

!www.TradersEdgeSystems.com

!INPUTS:

Periods is 14.

Periods1 is 3.

Pds is 70.

Pds1 is 3.

smaLen1 is 70.

exitType is 1.

!ABBREVIATIONS:

C is [close].

H is [high].

L is [low].

!INDICATOR CODE:

STOCD is (C-LOWRESULT(L,Periods))/(HIGHRESULT(H,Periods)-LOWRESULT(L,Periods))*100.

SD is Simpleavg(Stocd,Periods1).

StocW is (C-LOWRESULT(L,Pds))/(HIGHRESULT(H,Pds)-LOWRESULT(L,Pds))*100.

SW is Simpleavg(Stocw,Pds1).

HD if hasdatafor(1000) >= 500.

SMA200 is simpleavg(C,200).

SMA200ndx is tickerUDF("NDX",SMA200).

!SYSTEM CODE:

Buy if SMA200ndx > valresult(SMA200ndx,1)

and SMA200 > valresult(SMA200,1)

and SW > valresult(SW,1)

and SD > valresult(SD,1)

and countof(SW < 20,5)>=1

and countof(SD < 20,5)>=1

and HD.

smaLen2 is smaLen1*2.

smaLen3 is smaLen1*4.

SMA1 is simpleavg(C,smaLen1).

SMA2 is simpleavg(C,smaLen2).

SMA3 is simpleavg(C,smaLen3).

PD is {position days}.

!EXIT TYPE 1 USES THE INDICATOR ONLY

!EXIT TYPE 2 IS TREND FOLLOWING

Sell if (SD < valresult(SD,1) and SW < valresult(SW,1) and exitType=1)

or (exitType = 2

and ((Valresult(C,PD)valresult(SMA1,PD) And Cvalresult(SMA2,PD) And Cvalresult(SMA3,PD) And C 250)).

RSS is C/valresult(C,120).

RSL is C/valresult(C,240).

An Obscure but Potentially Useful Oversold Indicator

Trend-following is essentially a “tried and true’ approach to investing. But overbought/oversold (i.e., attempting to buy low/sell high) – that’s where the “excitement” is. Of course, when it comes to trading and investing, “excitement” can be highly overrated. Nevertheless, in this piece I want to talk about a relatively obscure indicator that may be useful in identifying vastly oversold situations.

EDITORS NOTE: The AIQ EDS file for Jay Kaeppel’s indicator is available to download at

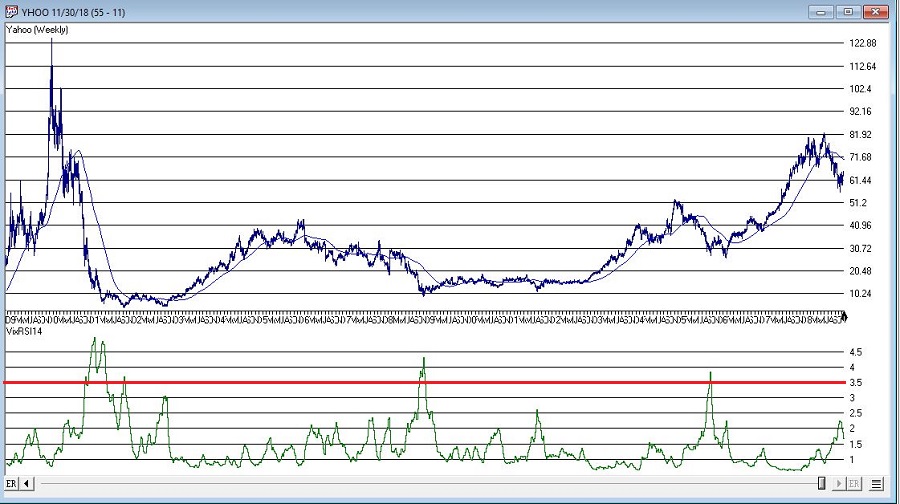

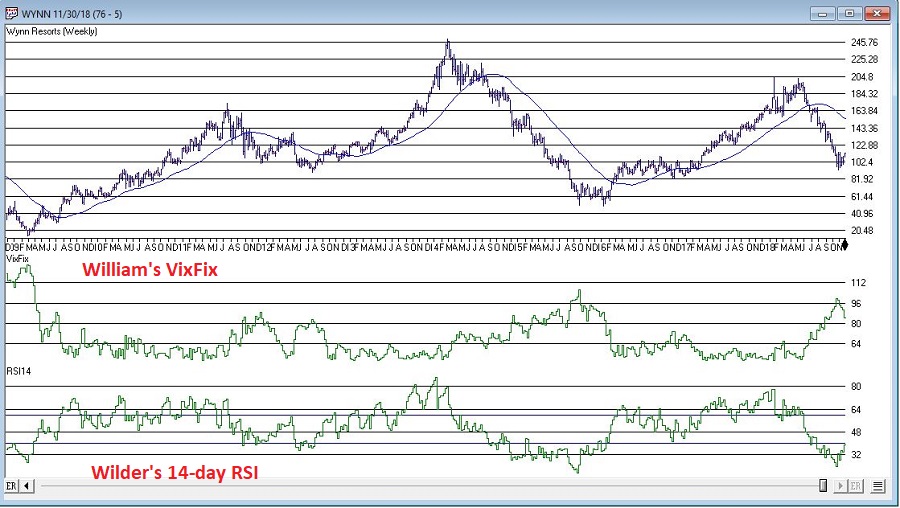

The VixRSI14 Indicator

Part of the reason this indicator is obscure is because I think I “invented” it – but only by mashing together an indicator from Larry Williams and an indicator from Welles Wilder. The first part is the standard Welles Wilder 14-day Relative Strength Index, more commonly referred to as “RSI”.

The 2nd part of VixRSI14 is an indicator created by famed trader Larry Williams which he dubbed “VixFix”. This indicator is an effort to create a “Vix Index-like” indicator for any security.

AIQ TradingExpert code for these indicators appears at the end of the article.

A Few Notes

*For the record, VixRSI14 is calculated by taking a 3-day exponential average of VixFix and dividing that by a 3-day exponential average of RSI14 (are we having fun yet?). Please see code at the end of the article.

*I prefer to use VixRSI14 using weekly data rather than daily data

*(Unfortunately) There are no “magic numbers” that indicate that a completely risk-free, you can’t lose, just buy now and watch the money roll in” buying opportunity is at hand (Disclaimer: If there was, I would probably just keep it to myself and not bother writing the article – sorry, it’s just my nature). That being said, a decent “rule of thumb” is to look for a reading above 3.5 followed by a downside reversal.

(Click any chart below to enlarge)

With those thoughts in mind, Figure 1 displays a weekly chart of Wynn Resorts (WYNN) with the two indicators plotted separately below the bar chart.

Figure 1 – WYNN with William’s VixFix and Wilder’s RSI 14-day (Courtesy AIQ TradingExpert)

Note that as price declines, VixFix tends to rise and RSI14 tends to fall. VIXRSI14 essentially identifies “extremes” in the difference between these two. Figure 2 displays WYNN with VixRSI14 plotted below the bar chart.

Figure 2 – WYNN with VixRSI14 (Courtesy AIQ TradingExpert)

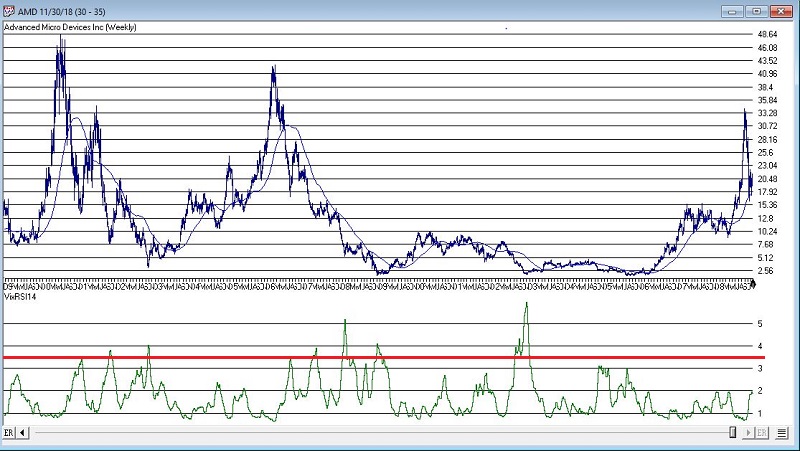

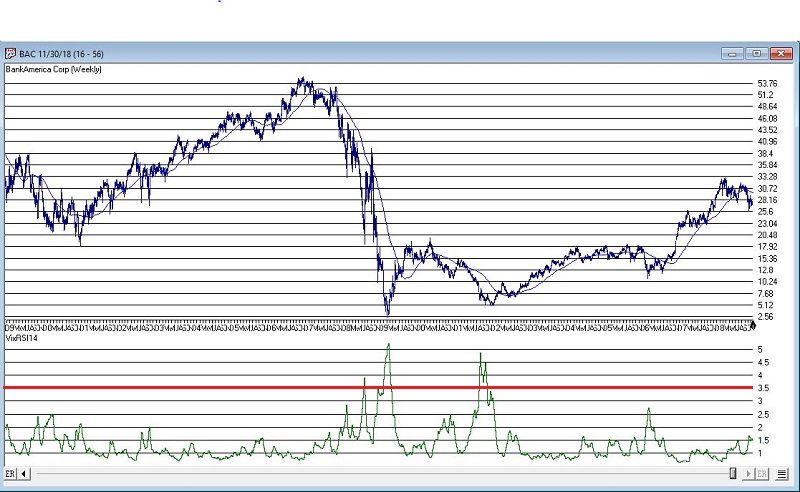

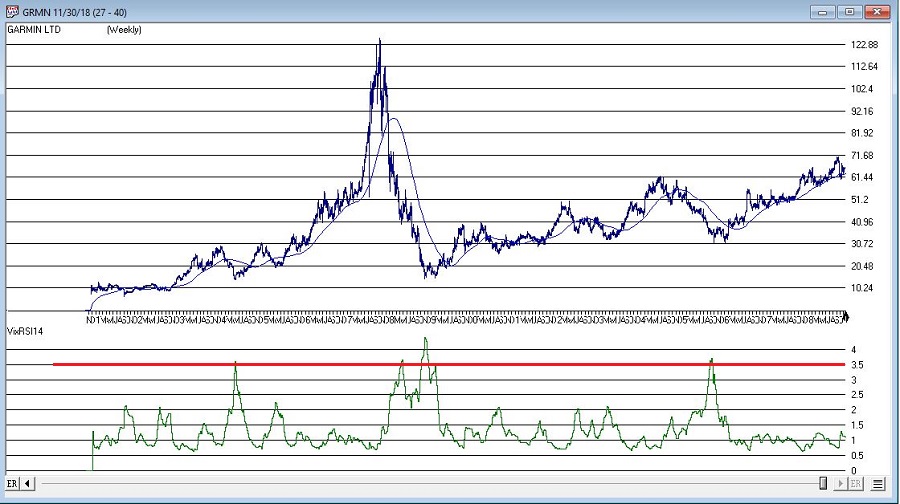

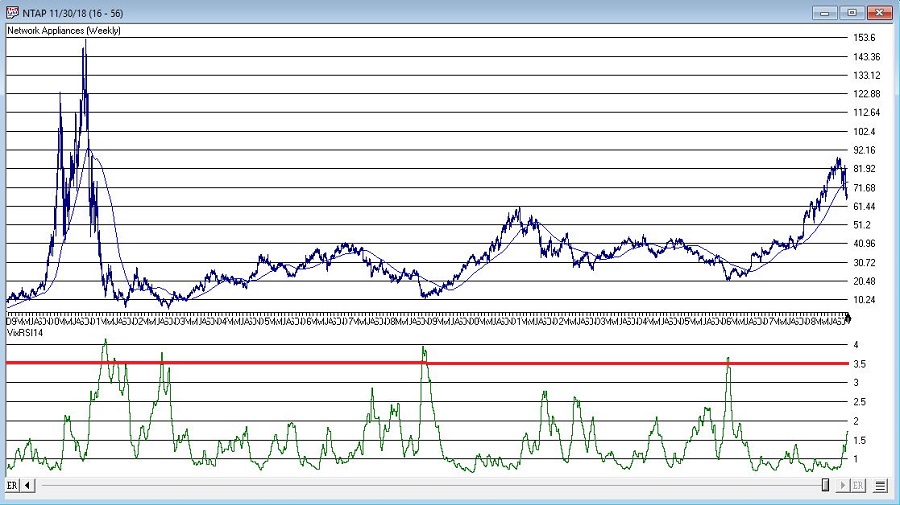

More “examples” appear in Figures 3 through 8 below.

Figure 3 – AMD (Courtesy AIQ TradingExpert)

Figure 4 – BAC (Courtesy AIQ TradingExpert)

Figure 5 – DISH (Courtesy AIQ TradingExpert)

Figure 6 – GRMN (Courtesy AIQ TradingExpert)

Figure 7 – NTAP (Courtesy AIQ TradingExpert)

Figure 8 – YHOO (Courtesy AIQ TradingExpert)

Summary

As always, I merely present “ideas” here at JOTM. So, do not assume from the charts above that you have found the “keys to the kingdom”. But if used in conjunction with other confirming indicators – and remembering to employ some sort of risk control for those instances when a stock price decline fails to arrest itself even after VixRSI4 peaks above 3.5 – VixRSI14 may hold some value.

Indicator Code

EDITORS NOTE: The AIQ EDS file for Jay Kaeppel’s indicator is available to download at

Below is the code for VixFix, RSI14 and VixRSI14 from AIQ Expert Design Studio.

!#######################################

!VixFix indicator code

hivalclose is hival([close],22).

vixfix is (((hivalclose-[low])/hivalclose)*100)+50.

!#######################################

!#######################################

!RSI14 code

Define days14 27.

U14 is [close]-val([close],1).

D14 is val([close],1)-[close].

AvgU14 is ExpAvg(iff(U14>0,U14,0),days14).

AvgD14 is ExpAvg(iff(D14>=0,D14,0),days14).

RSI14 is 100-(100/(1+(AvgU14/AvgD14))).

!#######################################

!#######################################

!VixRSI14 code

VixRSI14 is expavg(vixfix,3)/expavg(RSI14,3).

!#######################################

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

An Obscure But Useful Trend-Following Tool

Everyone has heard about trend-following. And most traders have at least a foggy grasp of the relative pros and cons associated with trend following. And anyone who has ever employed any type of trend-following technique is aware that they are great when there is an actual trend, but that whipsaws are inevitable.

What I am about to show you will not change these facts. But today’s piece is just a “quickie” to highlight an obscure way to use a common indicator as a “confirmation/ denial” check when assessing the trend of a given security. For the record, I am making no claim that this indicator generates profitably “trading signals in and of itself. Its one of those things that – and I hate this phrase as much as you do but – should be used in conjunction with other indicators to get a good sense of the current “state of the trend” for a given security.

Nothing more, nothing less.

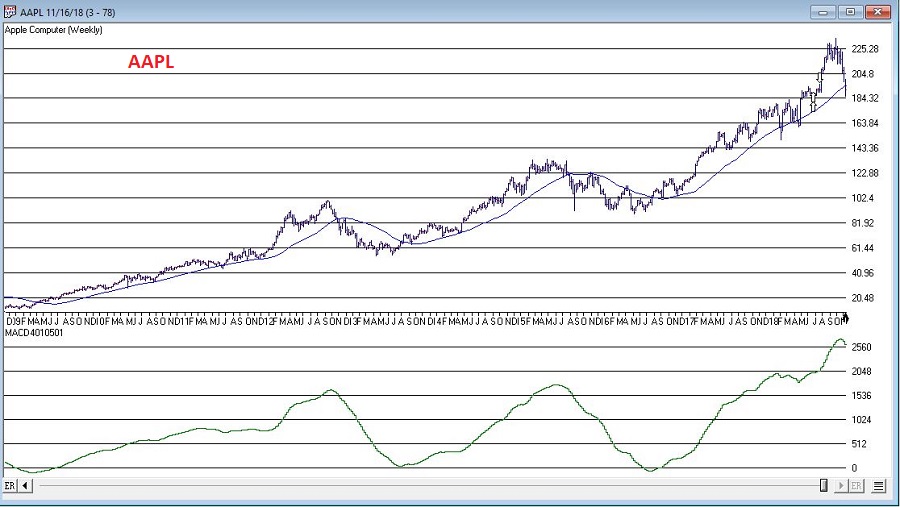

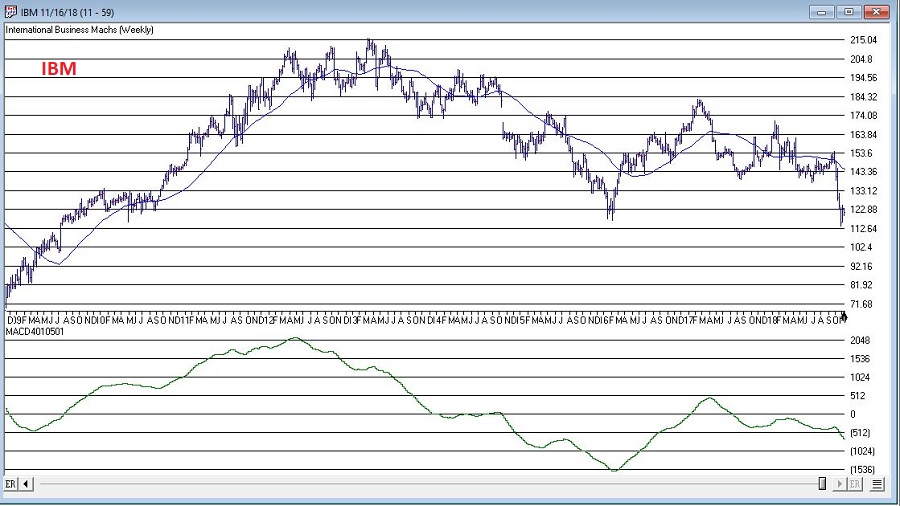

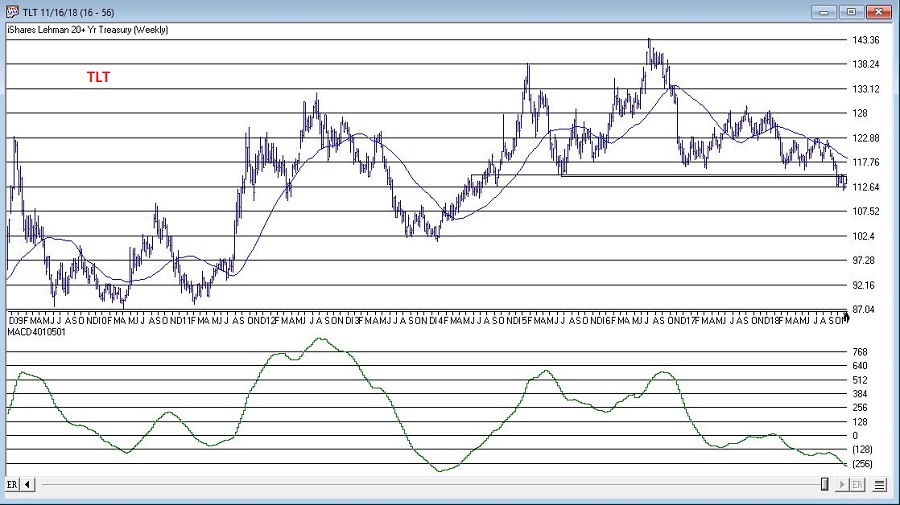

MACD Stretched Long

Most traders are familiar with the MACD indicator. Originally popularized by Gerald Appel, it uses a set of moving averages to attempt to assess the trend in price (and many traders also use it to try to identify overbought or oversold situations). Standard parameters are 9,26 and 12. The version I use is different in several ways:

*Whereas the standard MACD generates two lines and a histogram can be drawn of the difference between the two, this version just generates one line – we will call in the trend line (catchy, no?)

*We will use parameters of 40 and 105

*One other note is that (at least according to me) this indicator is best used with weekly data.

The MACD4010501

Here is the formula for AIQ TradingExpert Expert Design Studio:

Define ss3 40.

Define L3 105.

ShortMACDMA3 is expavg([Close],ss3)*100.

LongMACDMA3 is expavg([Close],L3)*100.

MACD4010501Value is ShortMACDMA3-LongMACDMA3.

As I said this should be used with “other” indicators. For example, one might consider the current price versus a 40-week moving average.

Standard Interpretation:

*If price is above the 40-week moving average (or if whatever other trend-following indicator you are using is bullish), AND

*The MACD4010501 is trend higher THEN

ONLY play the long side of that security

Likewise:

*If price is below the 40-week moving average (or if whatever other trend-following indicator you are using is bearish), AND

*The MACD4010501 is trend lower THEN

ONLY play the short side of that security (or at least DO NOT play the long side)

Finally, DO NOT assume that every change of trend in MACD4010501 is some sort of buy or sell signal. Consider it only as a filter for your trades.

Some random examples appear in Figures 1 through 4 (click to enlarge any chart)

Figure 1 – AMZN (Courtesy AIQ TradingExpert)

Figure 2 – IBM (Courtesy AIQ TradingExpert)

Figure 3 – WMT (Courtesy AIQ TradingExpert)

Figure 4 – TLT (Courtesy AIQ TradingExpert)

Summary

To repeat, the proper use of this obscure version of the popular MACD indicator is as follows:

*Consider the trend of MACD4010501

*Consider one or more other trend-following indicators

*If there is bullish agreement, then apply your own shorter-term entry and exit techniques to trade the long side.

*If there is bearish agreement, then apply your own shorter-term entry and exit techniques to trade the short side (or simply stand aside).

Trade on!

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

A Look Ahead in Stocks, Bonds and Commodities

In the interest of full disclosure, the reality is that I am not great at “predicting” things. Especially when it involves the future. That being said, I am pretty good at:

*Identifying the trend “right now”

*Understanding that no trend lasts forever

*Being aware of when things are getting a bit “extended”

So, I am going to highlight a few “thoughts” regarding how one might best be served in the markets in the years ahead.

Where We Have Been

*After 17 years of sideways action (1965-1982) the stock market has overall been in a bullish trend since about 1982 – albeit with some major declines (1987, 2000-2002 and 2007-2009) when the market got significantly overvalued.

*Bond yields experienced a long-term decline starting in 1981 and bottomed out in recent years.

*Commodities have mostly been a “dog” for many years.

The way the majority of investors approach these goings on is to:

*Remain bullish on the stock market (“Because it just keeps going up”)

*Continue to hold bonds (“Because I have to earn a yield somewhere”)

*Avoid commodities (“Because they suck – and they’re scary”)

And as an avowed trend-follower I don’t necessarily disapprove. But as a market observer I can’t help but think that things will be “different” in the not too distant future.

Considerations Going Forward

Stocks

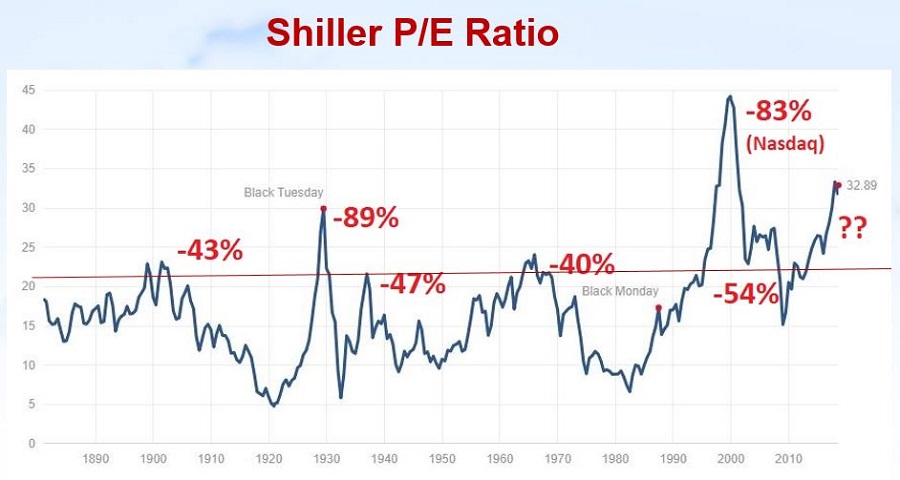

Figure 1 displays the Shiller P/E ratio. For the record, valuation measures are NOT good “timing” tools. They don’t tell you “When” the market will top or bottom out. But they do give a good indication of relative risk going forward (i.e., the higher the P/E the more the risk and vice versa).

Note:

*The magnitude of market declines following previous peaks in the P/E ratio

*That we are presently at (or near) the 2nd highest reading in history

(click on any chart below to enlarge it)

Figure 1 – Shiller P/E Ratio (and market action after previous overvalued peaks) (Courtesy: www.multpl.com/shiller-pe/)

The bottom line on stocks: While the trend presently remains bullish, valuation levels remind us that the next bear market – whenever that may be – is quite likely to be “one of the painful kind”.

Bonds

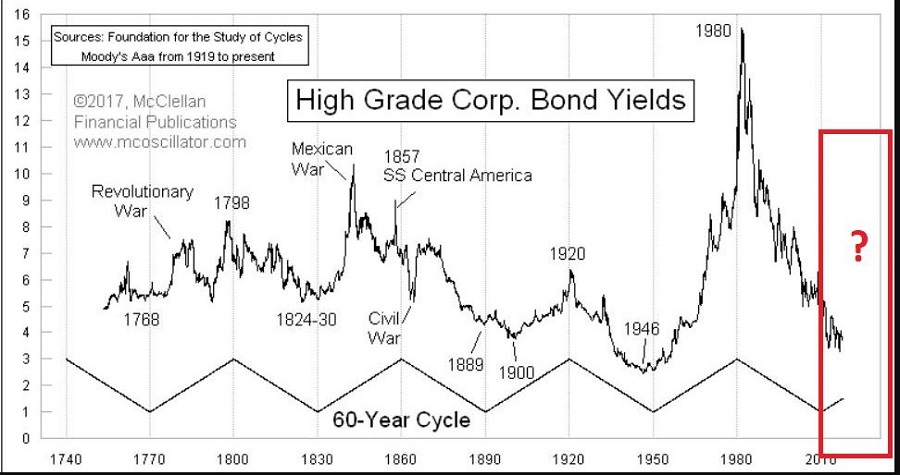

Figure 2 displays the 60-year cycle in interest rates.

Figure 2 – 60 -year cycle in interest rates (Courtesy: www.mcoscillator.com)

Given the historical nature of rates – and the Fed’s clear propensity for raising rates – it seems quite reasonable to expect higher interest rates in the years ahead.

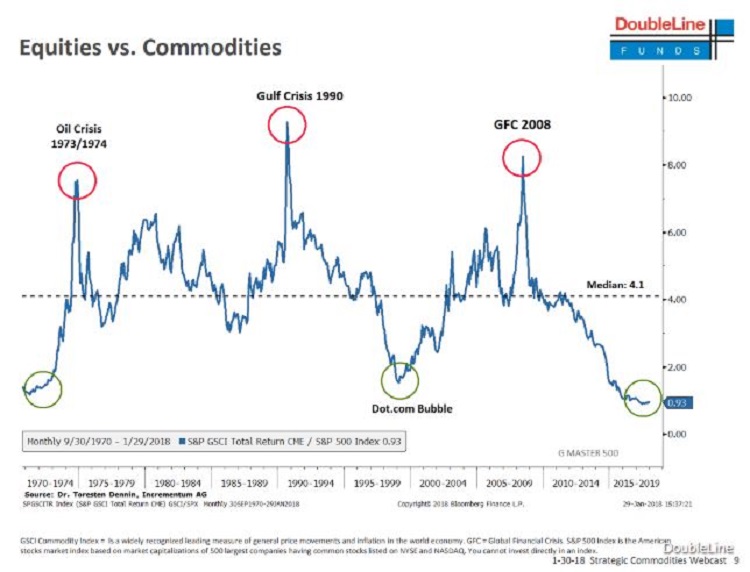

Commodities

As you can see in Figure 3 – which compares the action of the Goldman Sachs Commodity Index to that of the S&P 500 Index) – commodities are presently quite undervalued relative to stocks. While there is no way to predict when this trend might change, the main point is that history strongly suggests that when it does change, commodities will vastly outperform stocks. Figure 3 – Commodities extremely undervalued relative to stocks (Courtesy: Double Line Funds)

Figure 3 – Commodities extremely undervalued relative to stocks (Courtesy: Double Line Funds)

The Bottom Line – and How to Prepare for the Years Ahead

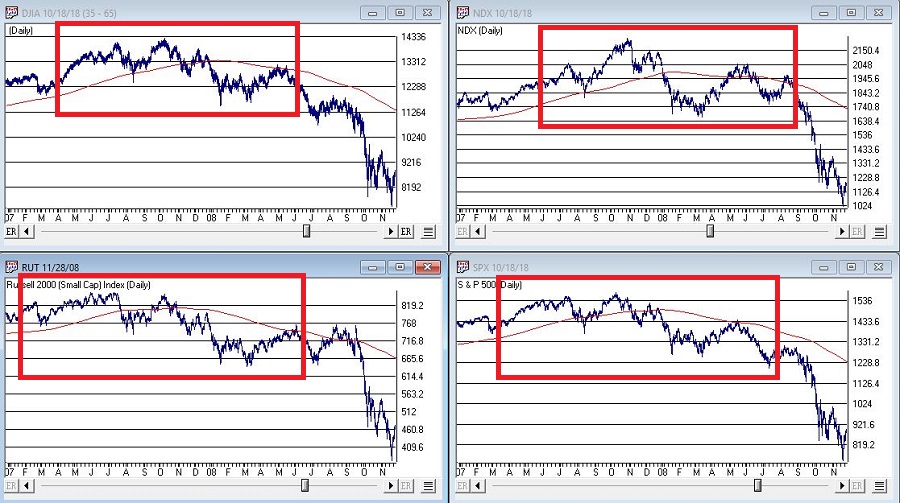

*No need to panic in stocks. But keep an eye on the major averages. If they start to drop below their 200-day averages and those moving average start to “roll over” (see example in Figure 4), it will absolutely, positively be time to “play defense.”

Figure 4 – Major stock average rolling over prior to 2008 collapse (Courtesy AIQ TradingExpert)

*Avoid long-term bonds. If you hold a long-term bond with a duration of 15 years that tells you that if interest rates rise one full percentage point, then that bond will lose roughly 15% in value. If it is paying say 3.5% in yield, there is basically no way to make up that loss (except to wait about 4 years and hope rates don’t rise any more in the interim – which doesn’t sound like a great investment strategy).

*Short-term to intermediate-term bonds allow you to reinvest more frequently at higher rates as rates rise. Historical returns have been low recently so many investors avoid these. But remember, recent returns mean nothing going forward if rates rise in the years ahead.

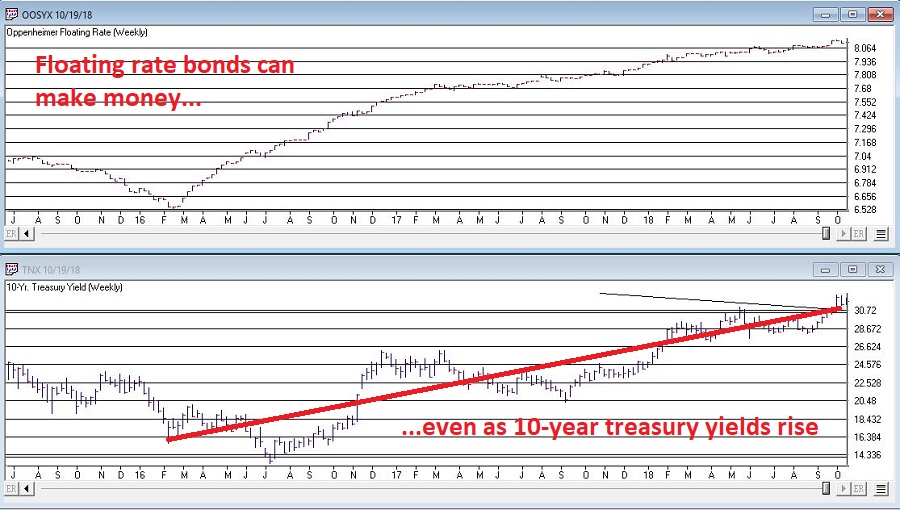

*Consider floating rate bonds. Figure 5 displays ticker OOSYX performance in recent years versus 10-year t-note yields. While I am not specifically “recommending” this fund, it illustrates how floating rate bonds may afford bond investors the opportunity to make money in bonds even as rates rise.

Figure 5 – Ticker OOSYX (floating rate fund) versus 10-year treasury yields)

*Figure 6 display 4 ETFs that hold varying “baskets” of commodities (DBC, RJI, DJP and GSG clockwise from upper left). When the trend in Figure 3 finally does reverse, these ETFs stand to perform exceptionally well.

Figure 6 – Commodities performance relative to stock performance (GSCI versus SPX)

Finally, the truth is that I don’t know “when” any of this will play out. But the bottom line is that I can’t help but think that the investment landscape is going to change dramatically in the years ahead.

So:

a) Pay attention, and

b) Be prepared to adapt

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.