April 7, 2020

Hello Everyone,

The 2020 COVID-19 Virus has adversely affected the entire world, and this will go down as one of the most volatile years in the stock and bond market in generations and even more volatile than the 2008 Bear Market.

CURRENT MARKET CONDITIONS:

This reason is that the declines came over eight days and not like the 2007-2009 decline which took a year and one half. The great recession of 2008 was a humanmade financial problem and this is a virus where very few are working. In the Recession of 2008, people were at least going to work and going out and spending money to support the economy. Now we are all destined to stay in the house unless we have an essential business. But the U.S. Government is doing everything it can to give grants and forgivable loans so that the economy doesn’t totally crash. That is better than in 2008. It is still serial to be confined to your house or go for a walk.

When we get our statement of our investments from our 401(k) s or from these accounts, you will see pretty large drops in values in the investment account and you will wonder if this is all worth it to stay in it or are we all destined just to make 1-3% in a savings account or a 3% fixed annuity with me. Right now getting 3% with no fees looks pretty good.

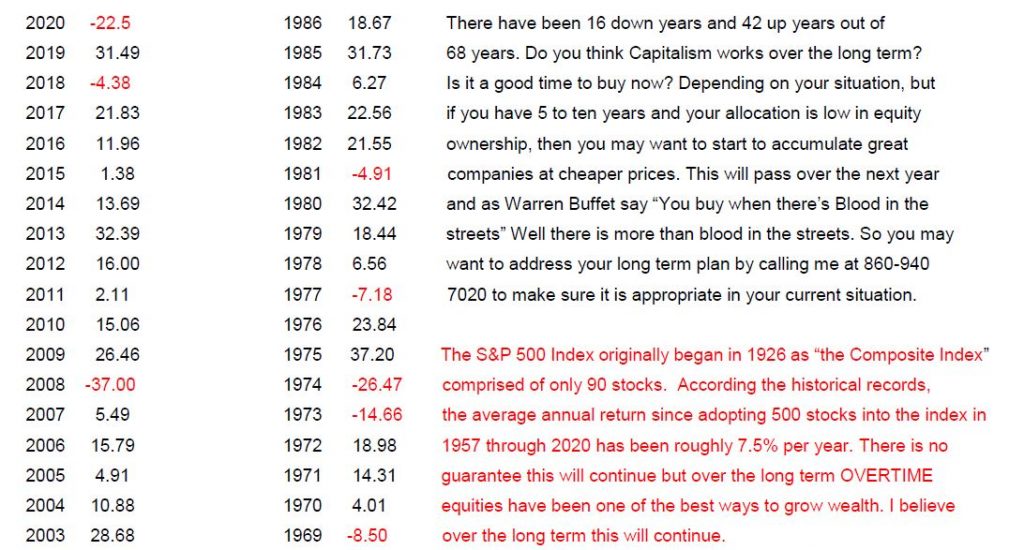

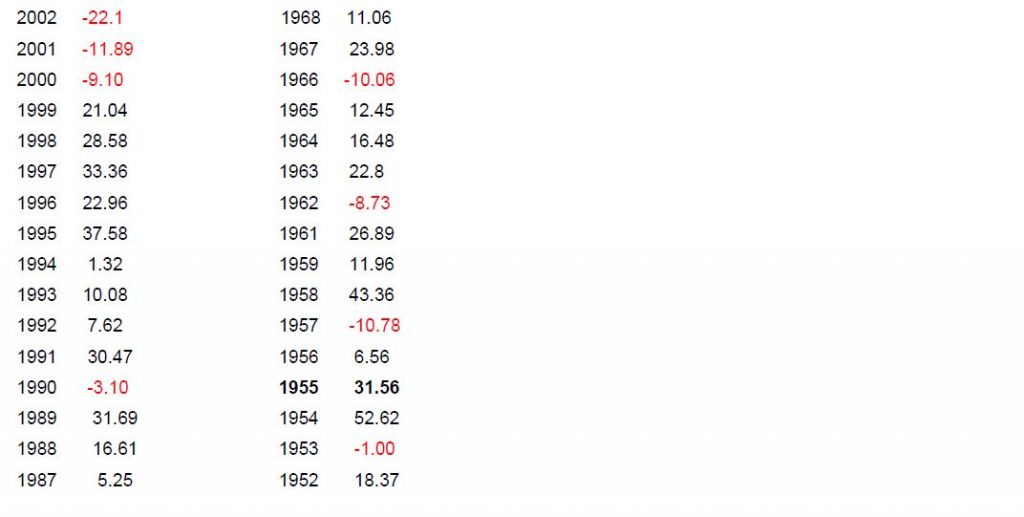

If you believe that good stocks and funds from successful growing businesses do well over the long term and this sell-off in the markets are BUYING opportunities over the next few months you may want to dollar cost average into the markets. If you believe that this COVID-19 virus will soon be over within months and that 1 to 3 years from now the markets will be higher than they are now is it worth holding on OR Buying more when markets are lower? The question is if you are buying or investing for the next 1-20 years. Do you like suitable stock and bond investments that are cheap now or more expensive? If your answer is yes, than you may want to average into the markets over the next few months as it is down during this pandemic.

MARKET RECAP:

On my last 3 Bartometers I was getting and got Very Cautious about the stock and bond markets, but did I expect this? Not really. I said if the NASDAQ broke 9200, I will get very Cautious but a 25 to 35% decline I did not expect. The markets had rallied 20%+ from the low hit a couple of weeks ago but still, the markets are down 17-20% into 2020. Are we in a recession now? I’d say yes, but it is forced because of COVID-19, but it will be one just because of the number of people laid off.

In the following pages are discussions of the long term of the markets, what do in a Bear market and my technicals of the markets going forward. But above I would like to say that even though American Capitalism is under fire, and also though the market got hurt as well as our portfolios, we will rise to the COVID-19 challenge like any other war or attack on the United States of America going back to the Revolutionary War to WW1, WW2, and all the other wars we had in our history. This country and its citizens will find a vaccine to this virus and I believe in my heart that 1 to 2 years from now this market should be nicely higher. Dollar-cost averaging currently buying a lower priced shares of good companies should, with no guarantees expressed or implied, be a good deal higher over the next few years. What do you think? Have we gone down this much over the last 50 years? Yes, many times. Has it recovered each time? Yes. Because capitalism works and good companies over the long term make money.

Some of the INDEXES of the markets both equities and interest rates are below. The source is Morningstar.com up until April 7, 2020. These are passive indexes.

*Dow Jones -20%

S&P 500 -17%

NASDAQ Aggressive growth -9%

I Shares Russell 2000 ETF (IWM) Small cap -31%

Midcap stock funds -29%

International Index (MSCI – EAFE ex USA -22%

Investment Grade Bond -4%

High Yield Bond -13%

Government bond +4%

The average Moderate Fund is down -16% this year fully invested as a 65% in stocks and 35% in bonds and nothing in the money market.

WANT TO SHOW YOU THE YEAR BY YEAR RETURNS OF THE S&P 500 TOTAL RETURNS BY YEAR

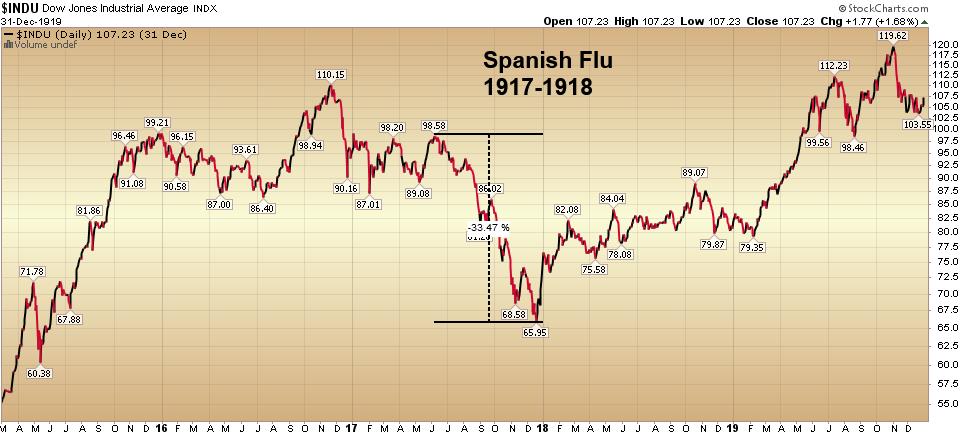

WHAT HAPPENED TO THE MARKETS DURING THE PANDEMIC AND SPANISH FLU IN 1917-1918:

The stock market today is looking a lot like it did a century ago, and if Great Hill Capital’s Thomas Hayes’s interpretation of the trendlines is on point, the bottom could be approaching.

“Just as the market started discounting the worst-case scenario in 1917,” he wrote, “it was already discounting a recovery months before the worst-case scenario occurred in 1918.”

What was going on in 1917? The Spanish Flu was just starting to bubble up, with the deadliest month of the whole pandemic not hitting until October 1918 — by then, as you can see from this chart, the Dow Jones Industrial Average DJIA, -1.68% had already begun to heal.

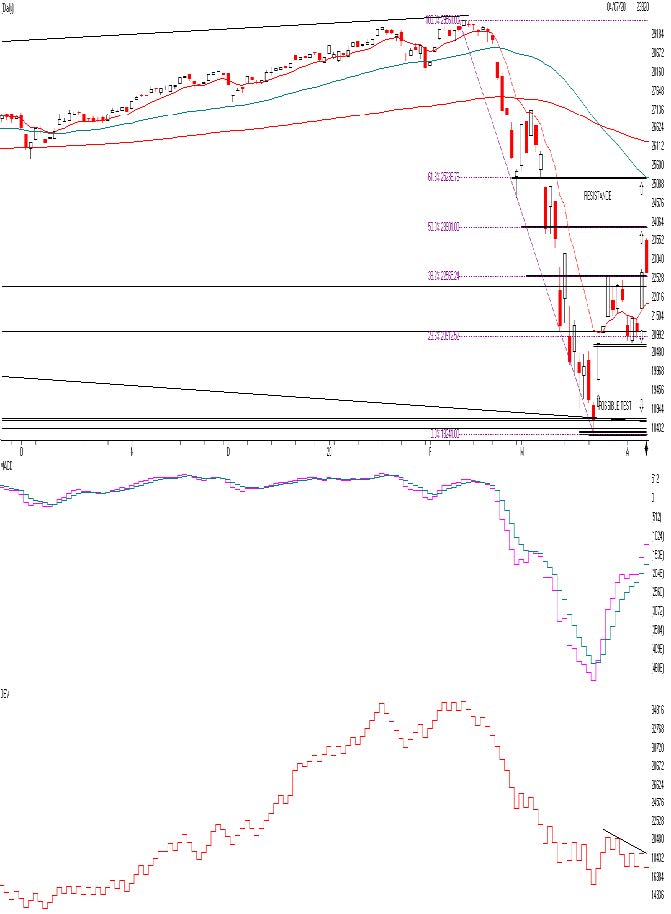

Hayes then posted this chart of the modern-day market plunge, noting that the nasty drawdowns amid the early stages of both pandemics were virtually the same.

More than 51 million people died globally in the Spanish Flu Pandemic, and the market rebounded more than 80% in the following two years from its bottom to top. This is no guarantee the market will rally that much or at all, but the USA is now better equipped to handle a massive Pandemic then in 1918 to 1919. Also, many companies are internet companies that could do well as people shop and do business over the internet; in addition, it is much more diversified and global than it was in 1918. For these reasons and more, I believe that the long term is more promising now for a recovery over the next 1 to 2 years.

There is one caveat; the Commodity index is right near its low of 2009, where it found it at a 29-year support level. If that breaks through that level, then we can go into a deeper recession for a more extended period.

The market rebound depends on how quickly the government fixes this problem and people go back to work. I am optimistic over the next two years; but understand a recession should happen at least for a few quarters. I think the Recession should be relatively short term.

Since this graph was made a week ago, look at the next page and it is up to date. COMPARE the next graph to the Pandemic of 1918 and it is starting to look more like it. There is no guarantee expressed or implied, but look at the Pandemic and then the updated Dow on the next page.

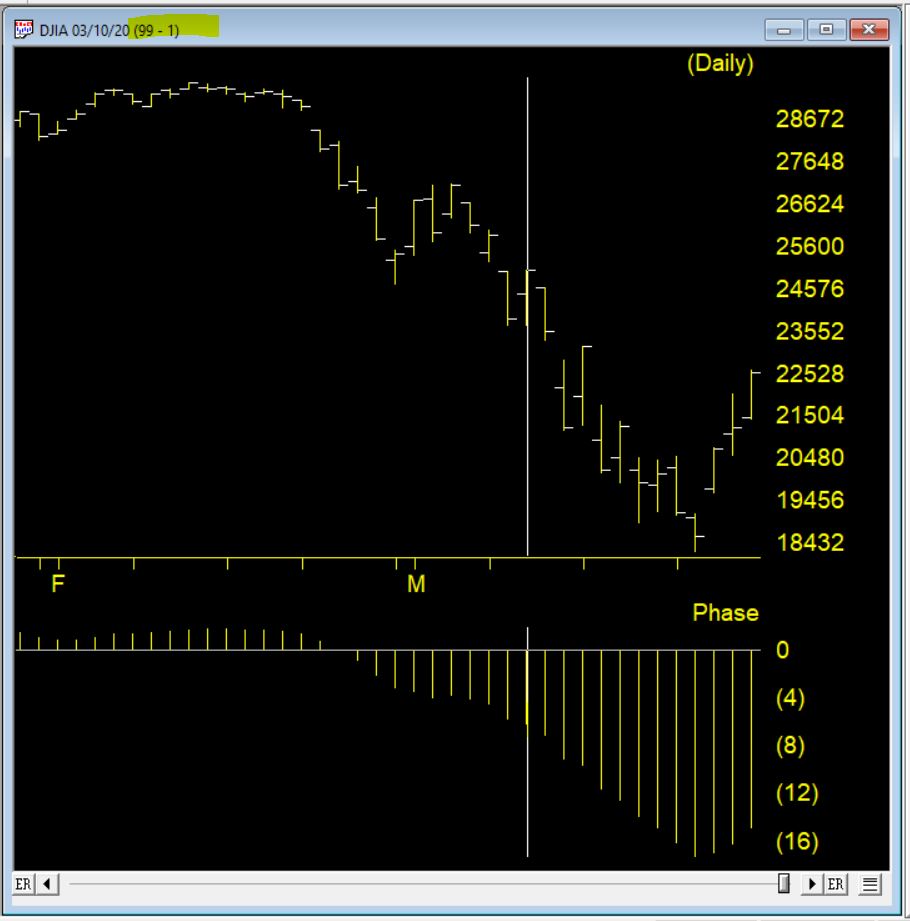

The Dow Jones is above. This is the Daily Chart. As you can see, the decline of the Dow Jones Average was relatively very quick. Current is sitting at 22653 right BELOW THE 50% Fibonacci retracement level. A normal BEAR market usually tops on a countertrend rally right at a 50% or 61.8% Fibonacci level and declines or puts in a short top. So if this is true in this case there could be resistance at 23,901 or 25,236 area. There is also some resistance at the 200 day moving average at 26,660 and sloping downward. My AIQ models gave a BUY on 3/24/2020, but only a short term Buy not a longer term Weekly Buy. So even though the market is somewhat short term Bullish, there could be a short term top at 23,901, 25,236 or the 26,660 areas.

Momentum is good but can change quickly on the downside after earnings come out that will be bad. A buy signal is giving when the lavender line crosses blue line and Sell signal when it does it on the downside

One thing I don’t like is the On Balance Volume Line. Notice as the market is going up it is going up on low relative volume. This is somewhat negative. Over all I think the market should be higher when this is all done and when there is a vaccine and people go on living their normal lives it should be better. This market will be volatile. The market may continue on the upside but over the short term I think the rally is limited to the levels I said above on the Fibonacci levels and the 200 day moving average. In addition, the market may not like the earnings numbers over the next couple of weeks and the market could drop again towards 20000 or below again.

Key investor Points to remember in a Bear Market:

- Stay calm and keep a long-term perspective.

- Maintain a balanced and broadly diversified portfolio.

- Balance equity portfolios with a mix of dividend-paying companies and growth stocks.

- Choose funds with a strong history of weathering market declines.

- Use high-quality bonds to help offset equity volatility.

- Advisors can help investors navigate periods of market volatility

THE BOTTOM LINE:

The market has had its worst decline in 10 years. It has recovered about 35% of the loss over the last week. It is not a time to sell during this decline in my opinion but for some of you it would a great time to start to nibble in your mutual funds on setbacks because the COV19 virus should be controlled over the next year and if you look at all of the virus pandemics we have had, it has been a good time to Buy if your goals are longer term. It is not a time to throw caution to the wind but call me to make selective dollar-cost average buys. In addition, when EARNINGS come out in the next 2 weeks the stock market could go back down again. Remember you buy when there is blood in the streets. Bonds should be more in the investment-grade or short- term investment grade side. If you are a long-term investor and have 20 years+ towards retirement use sell-offs to add through dollar-cost averaging. Diversification is essential but portfolios should be somewhat safer.

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

5 Colby Way

Avon, CT 06001

860-940-7020 or 860-404-0408

SECURITIES AND ADVISORY SERVICES OFFERED THROUGH SAGE POINT FINANCIAL INC., MEMBER FINRA/SIPC, AND SEC-REGISTERED INVESTMENT ADVISOR.

Charts provided by AIQ Systems:

Technical Analysis is based on a study of historical price movements and past trend patterns. There is no assurance that these market changes or trends can or will be duplicated shortly. It logically follows that historical precedent does not guarantee future results. Conclusions expressed in the Technical Analysis section are personal opinions: and may not be construed as recommendations to buy or sell anything.

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, and an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30-50% of its portfolio in different categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment-grade rating. The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating-rate coupon U.S. Treasuries, which have a maturity greater than 12 months.

Money Flow; The Money Flow Index (MFI) is a momentum indicator that measures the flow of money into and out of a security over a specified period. It is related to the Relative Strength Index (RSI) but incorporates volume, whereas the RSI only considers SK-SD Stochastics. When an oversold stochastic moves up through its MA, a buy signal is produced. Furthermore, Lane recommends that the stochastic line be smoothed twice with three-period simple moving averages: SK is the three-period simple moving average of K, and SD is the three-period simple moving average of SK

Rising Wedge; A rising wedge is a technical indicator, suggesting a reversal pattern frequently seen in bear markets. This pattern shows up in charts when the price moves upward with pivot highs and lows converging toward a single point known as the apex