Meanwhile, back in the bond market. Yes, the stock market has been the place for “action” recently. First a massive decline in short order followed immediately by a stunning advance. But many investors also look to the bond market in order to achieve their long-term goals. So, let’s try to put things in perspective a bit.

The Main Points

*Point A: Rates will likely work their way higher over time

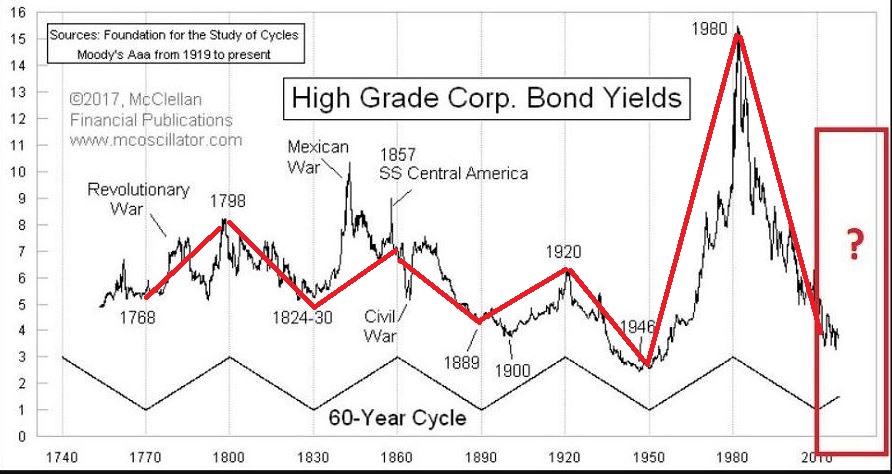

There has historically been a roughly 60-year cycle in interest rates (See Figure 1). If this holds to form, odds are the next 30 years will not look anything like the last 30 years in the bond market, i.e., rates will likely work their way higher over time.

Figure 1 – 60-year cycle in rates suggest higher yields in years ahead (Source: mcoscillator.com)

*Point B: Investors should be wary of buying and holding long-term bonds

Figure 1 does not mean that rates will rise in a straight-line advance. But again, odds are that rates will rise over time, so as a result, investors should be wary of buying and holding long-term bonds (as they stand to get hurt the most if rates rise). That being said, in the short-term anything can happen, and long-term bonds may still be useful to shorter-term traders, BUT…

…Short to intermediate term bond funds are better now for investors than long-term bonds (if rates rise over time investors in short/intermediate term bonds can reinvest more quickly at higher rates, while long-term bond holders just lose principal).

*Point C: It appears to be too soon to declare a confirmed “Bond Bear Market!!!”

Bond yields looked in 2018 like they were staging a major upside breakout – and then reversed back to the downside. So – Point A above not withstanding – it appears to be too soon to declare confirmed “Bond Bear Market!!!”

Figure 3 – 10-year treasury yield “breakout fake out” (Source: AIQ TradingExpert)

Figure 4 – 30-year treasury yield tested 120-month moving average, then failed (Source: AIQ TradingExpert)

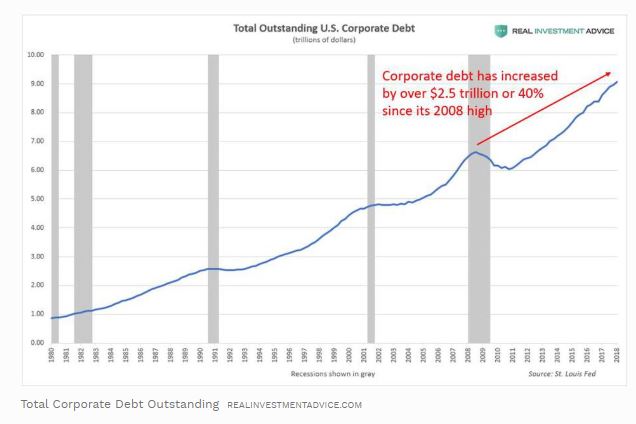

*Point D: Corporate bonds as a whole carry more risk than in years past

The risk associated with corporate bonds as an asset class are higher than in the past due to A) a higher rate of debt, and B) a large segment of the corporate bond market is now in the BBB or BBB- rating category. If they drop one grade they are no longer considered “investment grade” and many institutional holders will have no choice but to sell those bonds en masse. Which raises the age-old question, “too whom?”

For more on this topic see here, here and here. Figure 5 – Rising corporate debt (Source: Real Investment Advice)

Figure 5 – Rising corporate debt (Source: Real Investment Advice)

*Point E:

On the brighter side, two bond market models that I follow are presently bullish. More about these in Part II.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.