At first blush there might not seem to be much to connect biotech stocks and gold stocks.

One type of company hires people to engage in high tech biomedical engineering in order to develop potentially life-saving – or at least, life altering – medical breakthroughs…

…while the other hires people to (essentially) dig holes in the ground and mine stuff (granted, valuable stuff, but stuff mined out of the ground nevertheless).

But there is one other connection – stocks of both categories are quite volatile. And that alone may be enough to create a potential opportunity.

The BioGold Index

I created an “index” (such as it is) that combines Fidelity Select Biotech (FBIOX) and Fidelity Select Gold (FSAGX). The index appears in Figure 1. Like every other index in the world this index fluctuates up and down.

The RSI32 Index

The RSI32 Index is simply a 2-day average of the standard 3-day RSI Index. The code for AIQ TradingExpert EDS is below:

Define days3 5.

U3 is [close]-val([close],1).

D3 is val([close],1)-[close].

AvgU3 is ExpAvg(iff(U3>0,U3,0),days3).

AvgD3 is ExpAvg(iff(D3>=0,D3,0),days3).

RSI3 is 100-(100/(1+(AvgU3/AvgD3))).

RSI32 is simpleavg(RSI3,2).

The RSI32 Index for the BioGold Index appears on the monthly bar chart in Figure 2.

Figure 2 – The BioGold Index with RSI32 (drop to 33 or below = BUY) (Courtesy

AIQ TradingExpert)

The BioGold “System”

The BioGold System works as follows:

*When the monthly RSI32 Index drops to 33 or lower, buy BOTH FBIOX and FSAGX

*After a “Buy Signal” then when the monthly RSI32 rises to 64 or higher, sell BOTH FBIOX and FSAGX

For testing purposes we will use monthly total return data for both FBIOX and FSAGX from the PEP Database from Callan Associates.

The Results

Figure 3 displays the results of the buy signals generated using the rules above (assumes that both FBIOX and FSAGX are bought after monthly RSI32 drops to 33 or lower and are held until monthly RSI32 rises to 64 or higher.

| Buy Signal |

Sell Signal |

FBIOX+FSAGX % +(-) |

| 4/30/1992 |

12/31/1992 |

+14.4% |

| 2/26/1993 |

4/30/1993 |

+14.7% |

| 4/29/1994 |

9/30/1994 |

+7.2% |

| 12/30/1994 |

4/28/1995 |

+9.8% |

| 4/30/1997 |

9/30/1997 |

+18.4% |

| 11/28/1997 |

4/30/1998 |

+10.4% |

| 6/30/1998 |

12/31/1998 |

+16.1% |

| 3/30/2001 |

6/29/2001 |

+22.7% |

| 7/31/2002 |

12/31/2002 |

+18.1% |

| 7/30/2004 |

10/29/2004 |

+11.2% |

| 3/31/2005 |

7/29/2005 |

+10.2% |

| 4/30/2008 |

7/31/2008 |

+9.4% |

| 9/30/2008 |

6/30/2009 |

+3.8% |

| 5/31/2012 |

9/28/2012 |

+20.0% |

| 2/28/2013 |

2/28/2014 |

+28.6% |

| 8/31/2015 |

4/29/2016 |

+22.2% |

| 12/30/2016 |

2/28/2017 |

+13.2% |

|

Average % |

+14.7% |

|

Median % |

+14.4% |

|

Std. Deviation % |

6.4% |

|

Max % +(-) |

+28.6% |

|

Min % +(-) |

+3.8% |

Figure 3 – Trade-by-Trade Results

For the record, the “System” has been in FBIOX and FSAGX only 28% of the time (88 months) and out of the market 72% of the time (223 months).

Figure 4 displays the trades in recent years.

*The Good News is that all 17 signals since 1992 showed a profit, with an average gain if +14.7%.

*The Bad News is that, a) 17 trades in 25 years is a pretty small number of trades and, b) there are some not insignificant drawdowns along the way (-22.8% in 1998 and -22.4% in 2008, -14.1% in 2013 and -13.6% in 2016).

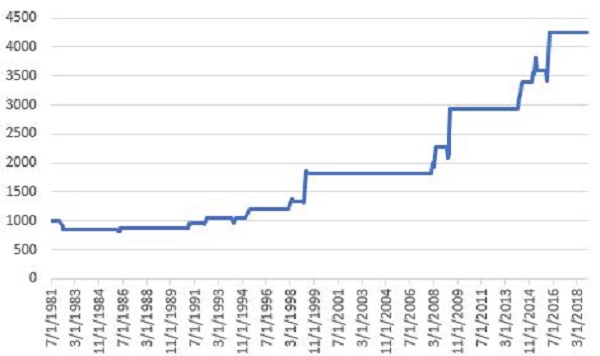

Still, for what it is worth the monthly equity curve appears in Figure 5.

Figure 5 – Growth of $1,000 invested using the “BioGold System”; 12/31/1991-12/29/2017

For the record, the “System” has been in FBIOX and FSAGX only 28% of the time (88 months) and out of the market 72% of the time (223 months).

For the record, the “System” has been in FBIOX and FSAGX only 28% of the time (88 months) and out of the market 72% of the time (223 months). No interest is assumed to be earned while out of the market in the test above.

If we invest in short-term treasuries (1-3 yr.) while not in the stock market we get the results shown in Figure 6.

In Figure 6:

*The blue line represents the growth of $1,000 achieved by holding FBIOX and FSAGX when the BioGold System is on a “buy signal” and 1-3 yr. treasuries the rest of the time.

*The red line represents the growth of $1,000 achieved by buying and holding both FBIOX and FSAGX and then rebalancing at the end of each year.

The “System” grew to $19,863 and the “split” grew to $12,844.

Figure 6 – Growth of $1,000 using BioGold System plus 1-3 yr. treasuries when out of stocks (blue) versus buying and holding FBIOX and FSAGX and rebalancing each year (red);12/31/1991-12/29/2017

Summary

So is the “BioGold System” really a viable investment idea? That’s not for me to say. The per trade returns are pretty good but there aren’t a whole lot of trades and if history is a guide an investor would likely have to ride some significant drawdowns in order to reap the gains.

Still, market-beating performance is market-beating performance, so who knows?

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.