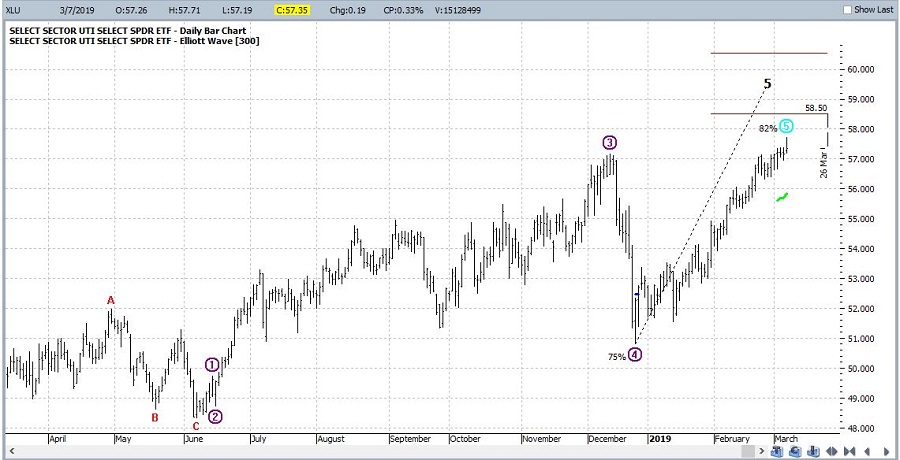

A lot of eyes are firmly fixed on Utilities at the moment. And for good reason. As you can see in Figure 1, the Dow Jones Utilities Average is presently facing a key resistance level. If it breaks out above the likelihood of a good seasonal rally (more in a moment) increases significantly.

Figure 1 – Utilities and resistance (Courtesy AIQ TradingExpert)

One concern may be the fact that a 5-wave Elliott Wave advance appears to possibly have about run its course (according to the algorithmically drawn wave count from ProfitSource by HUBB which I use). See Figure 2.

Figure 2 – Utilities and Elliott Wave (Courtesy ProfitSource by HUBB)

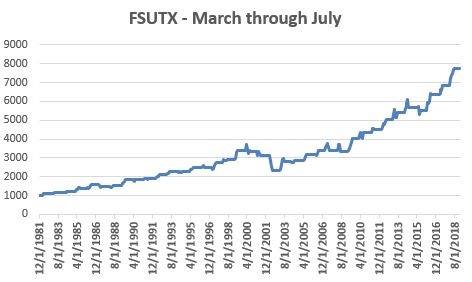

For what it is worth, the March through July timeframe is “typically” favorable for utilities. Figure 3 displays the growth of $1,000 invested in the Fidelity Select Sector Utilities fund (ticker FSUTX) ONLY during the months of March through July each year starting in 1982.

Figure 3 – Growth of $1,000 invested in ticker FSUTX Mar-Jul every year (1982-2018)

For the record:

*# times UP = 29 (78%)

*# times DOWN = 8 (22%)

*Average UP = +9.3%

*Average DOWN = (-5.8%)

*Largest UP = +21.1% (1989)

*Largest DOWN = (-25.8%) (2002)

*Solid performance but obviously by no means nowhere close to “a sure thing”.

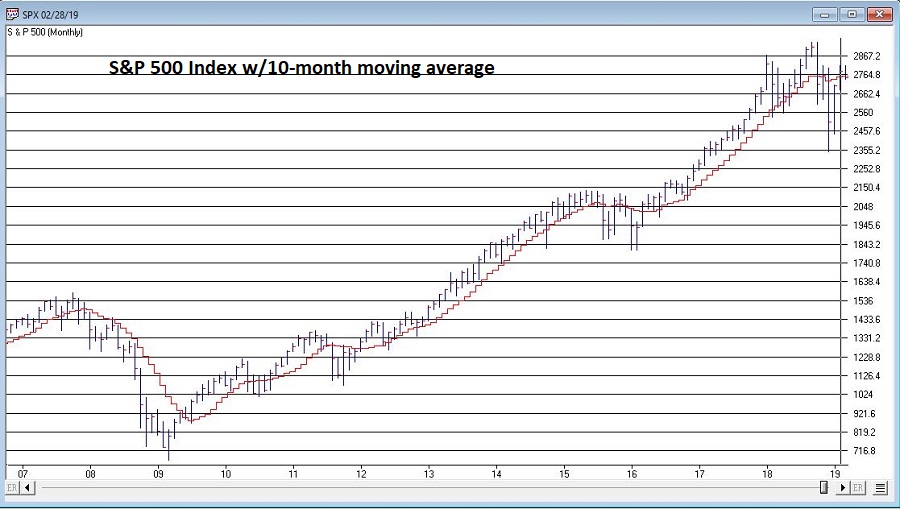

*It should be noted that several of the “Down” years occurred when the S&P 500 was already in a pretty clearly established downtrend (2001, 2002 and 2008), i.e., below its 10-month moving average. See Figure 4.

Figure 4 – S&P Index w/10-month moving average (Courtesy AIQ TradingExpert)

Summary

Utilities are flirting with new all-time highs and March through July is a “seasonally bullish” period for utilities. Does that mean “happy days are here again, and we should all be piling into utilities? Yeah, isn’t that always the thing about the markets? There is rarely a 100% clear indication for anything.

As always, my “prediction” about what will happen next in utilities is irrelevant and I am NOT pounding the table urging you to pile in. But I can tell you what I am watching closely at the moment:

*The S&P 500 Index is flirting right around its 10-month moving average (roughly 2,752 on the S&P 500 Index). If it starts to break down from there then perhaps 2019 may not pan out so well for utilities.

*The Dow Jones Utility Average is facing a serious test of resistance and may run out of steam (according to Elliott Wave).

*But a breakout to the upside could well clear the decks for utilities to be a market leader for the next several months

Focus people, focus.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.