While I am by and large an avowed “trend-follower” I also recognize that sometimes things get beaten down so much that they ultimately offer great potential long-term value. Or, as they say, “every dog has it’s day.” So, let’s consider some “dogs”.

For the record, and as always, I am not “recommending” these assets – I am simply highlighting what look like potential opportunities.

Dog #1: Soybeans (ticker SOYB)

As I wrote about in this article, soybeans are very cyclical in nature. According to that article there are two “bullish seasonal periods” for beans and one “bearish”:

*Long beans from close on the last trading day of January through the close on 2nd trading day of May

*Short beans from the close on 14th trading day of June through the close on 2nd trading day of October

*Long beans from the close on 2nd trading day of October through the close on 5th trading day of November

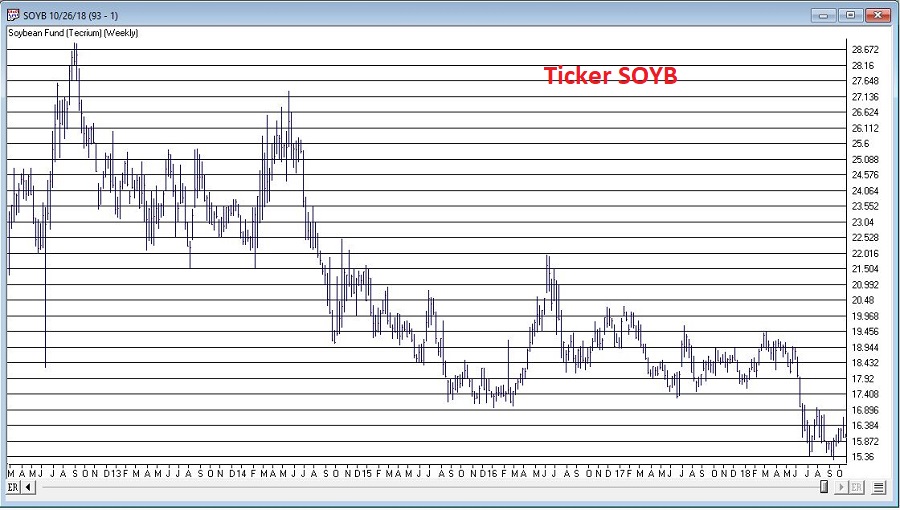

In Figure 1 (ticker SOYB – an ETF that tracks the price of soybean futures) has been beaten down quite a bit. This doesn’t mean price can’t go lower. However, given the cyclical nature of bean prices they probably won’t go down forever.

Figure 1 – Weekly SOYB; prices beaten down (Courtesy AIQ TradingExpert)

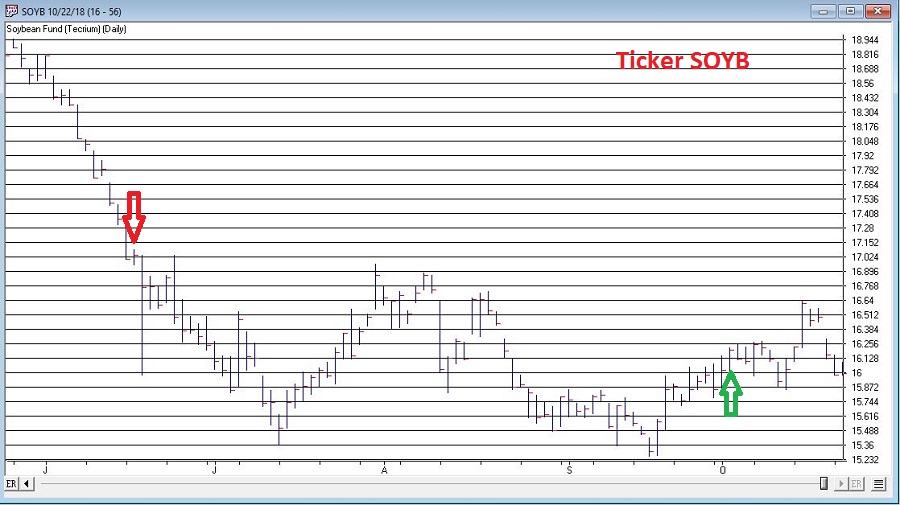

Figure 2 is a daily chart of SOYB and displays the recent “bearish” seasonal period and the latest “bullish” period so far.

Figure 2 – Daily SOYB (Courtesy AIQ TradingExpert)

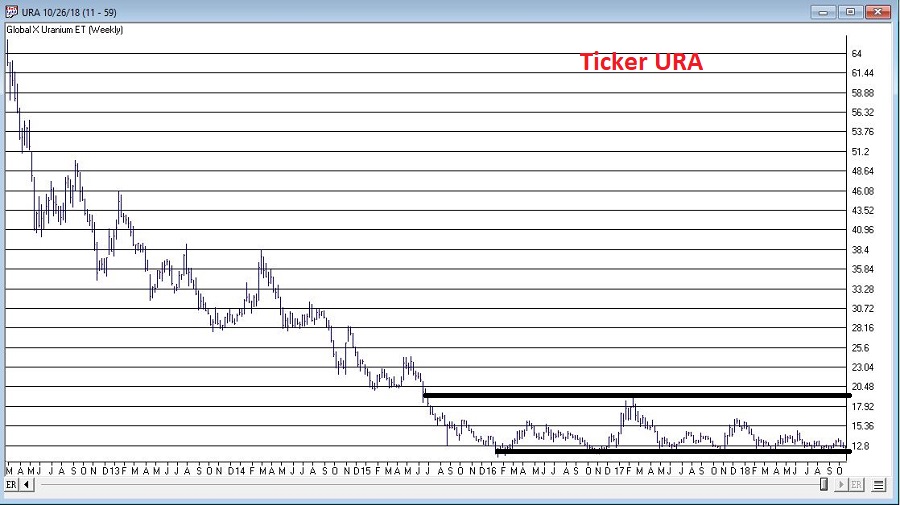

Dog #2: Uranium (ticker URA)

In this article and this article, I wrote about the prospects for uranium and ticker URA – an ETF that tracks the price of uranium. Since that time URA has basically continued to go nowhere. As you can see in Figure 3, it has been doing just that for some time. While there is no guarantee that the breakout out of the range indicated in Figure 2 will be to the upside, historically, elongated bases such as this often lead to just that. A trader can buy it at current levels and put a stop loss somewhere below the low for the base and take a reasonable amount of risk if they are willing to bet on an eventual upside breakout.

Figure 3 – Ticker URA with a long (really long) base (Courtesy AIQ TradingExpert)

Dog #3: Base Metals (Ticker DBB)

Under the category of – I called this one way, way too soon – in this article I wrote about the potential for ticker DBB to be an outperformer in the years ahead. As you can see in Figure 4, so far, not so good.

Figure 4 – Base Metals via ticker DBB (Courtesy AIQ TradingExpert)

Still, the argument for base metals is this:

*In Figure 3 is this article you can see that commodities as an asset class are due for a good move relative to stocks in the years ahead.

*In addition, the Fed is raising interest rates.

As discussed historically base metals have been the best performing commodity sector when interest rates are rising. Ticker DBB offers investors a play on a basket of base metals.

Summary

Will any of these “dog” ideas pan out? As always, only time will tell. But given the cyclical nature of commodities and the price and fundamental factors that may impact these going forward, they might at least be worth a look.

In the meantime, “Woof” (which – as far as I can tell – means “Have a nice day”).

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.