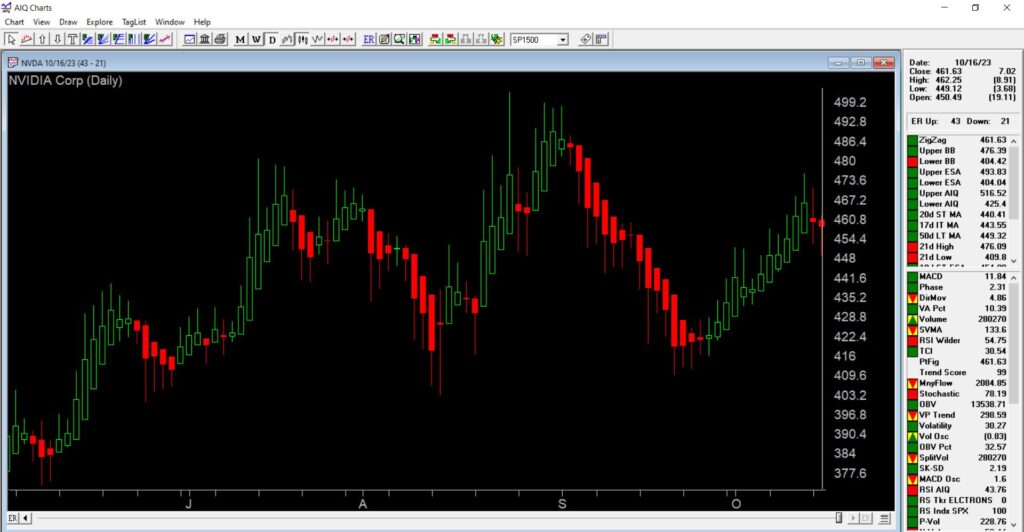

In this video I’ve covered the last 6 months of up and down Market ratings generated by the Artificial Intelligence system in our TradingExpert Pro analysis platform. #marketanalysis #markettiming #dowjones #ai #AIQsystems.

Break Free from Market Noise! 🚀 Uncover Hidden Trades with TradingExpert Pro’s AI-Based Signals and Charting Power! 📈📊

Tired of constant advice and rumor mongering? TradingExpert Pro brings you:

🌟 AI-Based Signals: Gain an edge with award-winning AI-based expert systems that screen for trading candidates others might miss.

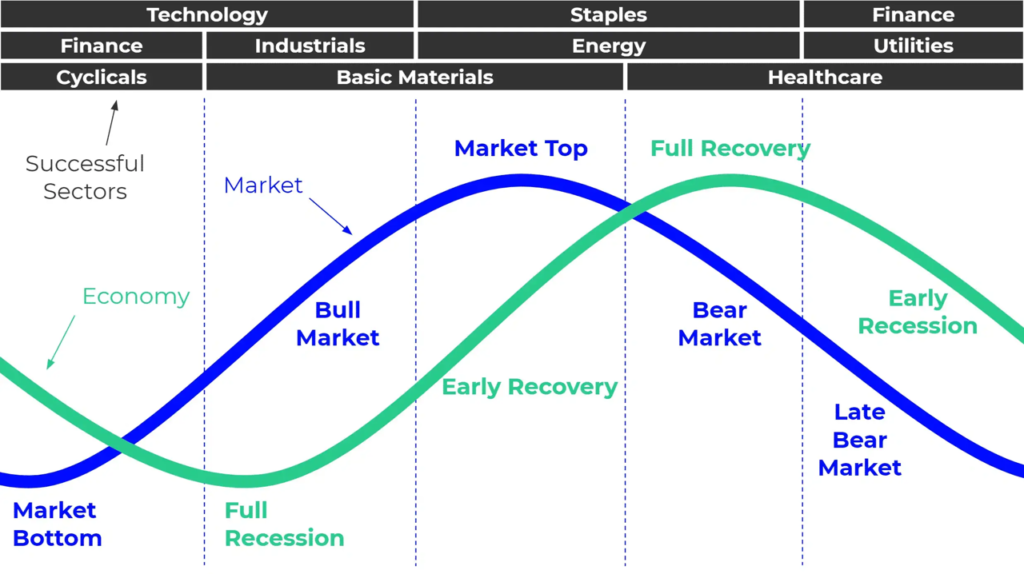

🚀 Top Industry Sectors: Zero-in on leading and lagging issues with daily group and sector analysis reports.

⏰ Time-Saving Analysis: The Chart Barometer provides instant evaluations of indicators, saving you time for a clear analysis.

🔍 Explore Feature: Fast searching of lists and industry groups, combining superb chart displays with an easy user interface.

📊 Custom Layouts: Every chart your way! Choose price bar, candlestick, or point and figure charts, and customize layouts effortlessly.

🔄 200 Screening Reports: Access one and two-page reports highlighting trading candidates automatically generated each day.

🛠️ Expert Design Studio: Design, test, and automate trading ideas easily. Pre-built strategies include Growth, Divergence, Short Selling, Day Trading, and more.

🌐 Whether stocks, mutual funds, futures, FOREX, or markets, TradingExpert Pro empowers your trading journey. Ready to revolutionize your trading experience? Explore the possibilities now! 🚀💹”

TradingExpert Pro End of Day 30-day trial with subscription to end of day data only $1*

OR CALL AIQ SALES on 1-800-332-2999 or 775-832-2798

* after 30 days price reverts to $99/mo. unless canceled by e-mailing support@aiqsystems.com or calling 1-800-332-2999