Category Archives: educational newsletters

The State of Dividends for U.S. Stocks

Energy and Materials issues are expected to remain under pressure for 2016, potentially resulting in disappointing announcements for earnings, capital investments, buybacks and dividends. Assuming dividend policies remain unchanged, the U.S. equity market in 2016 is positioned to set another record in payments, especially in the S&P 500®, but the increase is seen as being in the mid-single digit range, not the double-digits seen over the past few years.

The good news for dividends is that, while things are difficult, the majority of issues continue to increase and have the resources to do so for the near future.

Weekend Strategy Review July 10, 2016

Tried, Tested, Working – even in these volatile markets

Have you ever bought a stock you thought had great earnings, only to see it fail miserably?

It is not enough to have a list of great fundamental stocks. You must go deeper into the analysis of each final candidate on the list. But, what other analysis can be done? At Top Stock Analyzer we use our own proprietary tool, we call the the FATI® Score to help us unlock profits.

The FATI® Score is based upon leading investment research studies which show stocks with a lower standard deviation of earnings estimates from the consensus (higher degree of agreement among analysts) the better performance of the stock.

Here’s an excerpt from our May 30, 2016 newsletter and the long stock that the FATI® Score highlighted

the telecom and utilities industries. The firm provides engineering, construction and maintenance services. They

have a long list of prominent clients, such as AT&T, Verizon, Comcast and Century Link.

growth due to the high demand for network and mobile bandwidth. As the bandwidth demand grows, customers need to

expand the capacity of their networks. This demand has created a backlog of over $5.6 billion is contract work

for Dycom. With this years sales growth estimated at over 26% earnings should continue to be outstanding.

As of 7/6/2016 DY was up 6.59%

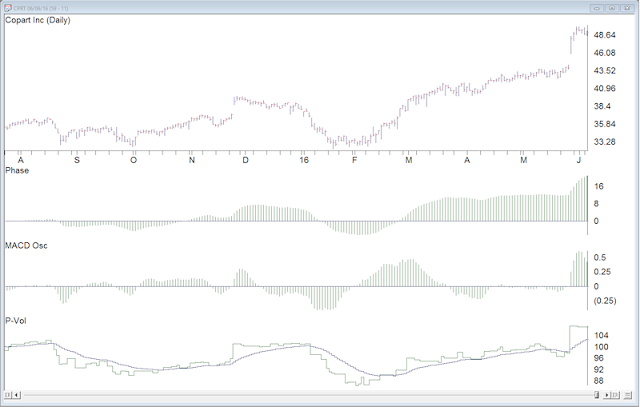

Here’s an excerpt from our June 6, 2016 newsletter and the long stock that the FATI® Score highlighted

process or sell salvage and marketable vehicles. The buyers and sellers include

insurance companies, banks and financial institutions, car dealerships, fleet

operators, and vehicle rental companies, licensed dealers and of course the

general public as well.

established in Canada, Europe, South America and India. With increasing

revenues. declining expenses and global expansion into the Middle East, Copart

has been hitting on all cylinders. So far in 2016 the company has added 4 new

facilities to handle the increase in volume. Two in Colorado and two in Texas.

across quarterly and annual estimates. With a three year projected EPS growth

rate of 27% the party is not over yet. The P/E of 23 may sound expensive on a

relative basis, but with its EPS growth rate, it is actually reasonable.

As of 7/6/2016 CPRT was up 1.15%

The ‘Short Side’ List

We also analyze for candidates to consider shorting for downward trending markets. The criterion for screening is not exactly the opposite of the long screen. To be most effective with the short list and minimize your risk associated with shorting, it is best to look for newcomers to the short list on a weekly basis.

Remember, shorting is an advanced trading technique. You have unlimited loss potential, so remember to be selective, use a stop loss order and only short in a confirmed downward trending market.

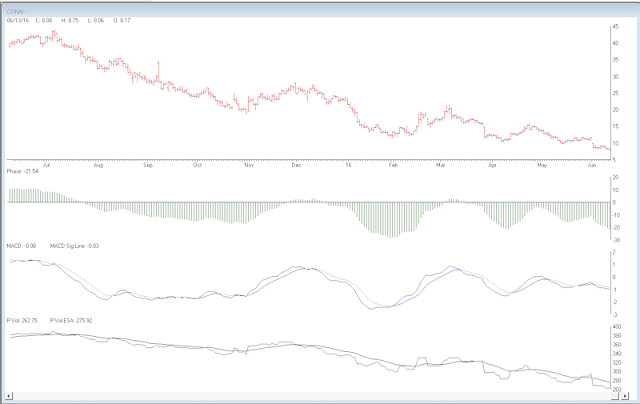

Here’s an excerpt from our June 13, 2016 newsletter and the short stock that the FATI® Score highlighted

part of the U.S., in particular Texas and Louisiana. They sell home appliance

and garden equipment along with an array of other electronics. The company has

seen their gross margin severely impact by the rising cost of goods. In

addition their interest expense has doubled over the past year. These items, as

well as others have cause a severe contraction in earnings.

Earnings are expected to decline -89% this year, the P/E stands at 73 and F1

estimates have fallen from $1.77 to $0.11 over the past 90 days. Of the six

analysts following the stock, there doesn’t appear to be any agreement on the

actual EPS as depicted in a FATI Score of 534. Remember, anything over a score

of 12 or higher is disqualified from our long recommendations list.

of Conn, Inc. fundamentals, we see this as a good shorting opportunity. As with

any short trade, place a stop order and monitor the stock daily.

As of 7/6/2016 CONN was up 12.73%

Putting it All Together

There you have it. “Fundamentals Made Simple”. Just select your stocks from the list and go right into your technical analysis. All the fundamental screening has already been done for you. Each and every week you will receive an updated screening of Top Stock Analyzer with the power of the FATI® Score. You can see the score of each stock.

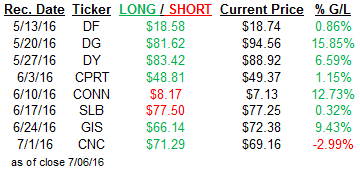

Here’s our featured stock performance as of 7/6/2016

Our weekly newsletter is a collaboration between AIQ Systems LLC and Fortunatus Advisors, Inc. if you want to learn more about our service visit

One of the things …….. is that the U.K. is not in great financial shape right now – comments June 21, 2016

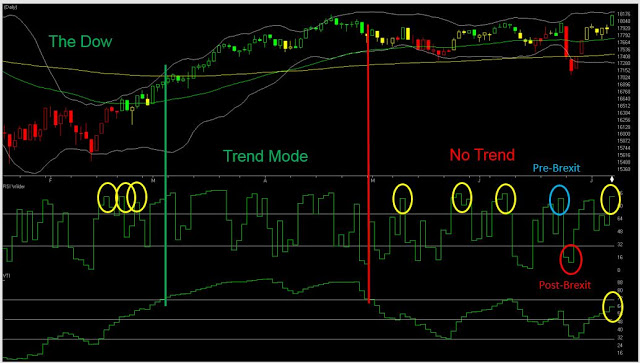

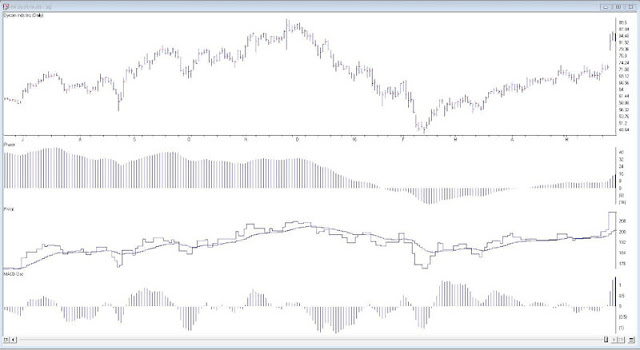

The Dow shot up over 270 points at the open, then spent the rest of the day giving back about half of those points to close up 130 at 17,805. Volume was moderate, coming in at 96 percent of its 10-day average. There were 178 new highs and only 9 new lows.

Try our Cum Laude service for 2 weeks and receive 8 nightly updates (just like this one)

PLUS the Dean’s List of favored stocks

| DMI (DIA) | NEG |

| DMI (QQQ) | NEG |

| COACH (DIA) | NEG |

| COACH (QQQ) | NEG |

| A/D OSC | |

| DEANs LIST | POS |

| THE TIDE | NEU |

| SUM IND | NEG |

Try our Cum Laude service for 2 weeks and receive 8 nightly updates (just like this one)

PLUS the Dean’s List of favored stocks