The Dow rallied for 251 points on Friday, closing at 18,147. It was up 197 points for the week. The NASDAQ finished up 80 points on Friday and up 94 points for the week.

After the BLS said that 287K new jobs were created in June, the market shot up and tested the April 20 high. The Dow actually came within one point of making a new high before pulling back from overbought conditions.

This week I’m posting three charts that show where the Dow, Gold, and the Dollar are in their current patterns.

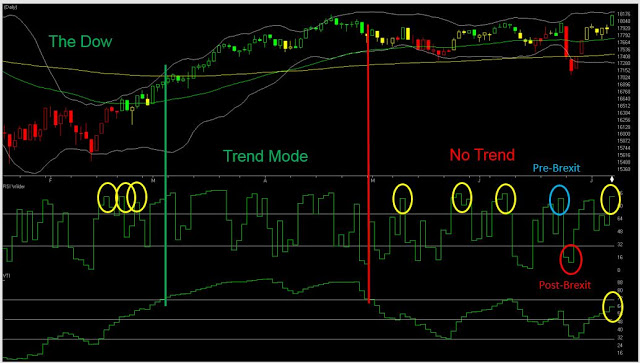

The first chart of the Dow shows that once again, the 2-period RSI Wilder is overbought with No Trend in place. So the Dow should start to pull back early next week.

Gold and the Dollar are another matter. As you can see from the second chart, GLD continues to remain in a strong uptrend. The VTI is above the 70 level and continues to move higher. GLD closed at 130.52 on Friday and appears to be right on track for a move to the 134+ level.

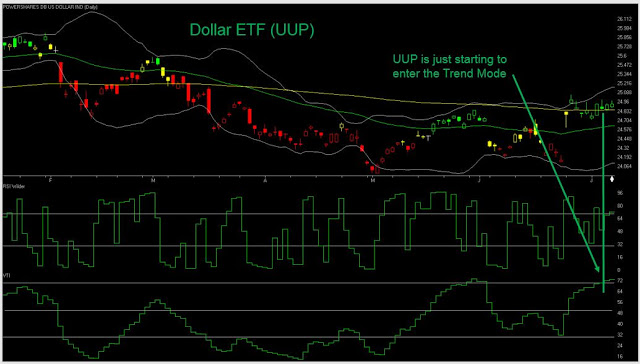

But the chart of the Dollar shows a fly in the ointment. For the past three days, the VTI on the chart of UUP is showing that it is also starting to enter the Trend Mode. This is a major concern, because it is extremely unusual for the Dollar and Gold to be rising at the same time. The only time this tends to happen is when there is major trouble in the world.

It happens because people are so concerned about their money that they are flocking to safe havens. And it’s not only happening with individual investors, it’s happening with companies too. We’re seeing this in a lot of European countries now where investors are willing to pay the banks money (negative interest) just so they can get their money back at some point in the future. It’s insane!

Prior to Brexit, I warned that this could happen. I said U.S stocks, gold and the Dollar could be perceived as safe havens, and all three could rise post-Brexit. But I don’t believe this condition will last. Something has to give. A strong dollar makes it extremely difficult for most U.S. companies to sell their products abroad. It will impact their earnings. There are no two ways about it. As long as the dollar continues to rise, large cap U.S. stocks will face strong headwinds.

And right now, most U.S. stocks are not cheap. The current P/E ratio for the S&P500 is a whopping 24.61! Compare this to its historic mean of 15.60 and you will quickly see that stocks are severely overvalued. The reason they are being priced so high now is because companies are buying back shares, and investors are being pushed into stocks because most other investments are paying diddly squat. This is a very dangerous situation.

The fact that most companies are buying back their own shares is really something you should think about. Usually the only time a company buys back its own shares is because they believe the stock price is too cheap! The stock price might have been reduced because of a temporary slip in earnings or some unusual one time event. In normal times, a company would not do this. In normal times, a company would use any excess cash it generates to expand. They would buy additional equipment or hire more people. After all, they’re in business to make money. But this is NOT happening now. The reason its not happening now is because companies are worried. They are not buying new equipment or hiring new workers despite the fact that the June Jobs Report was positive. Given May’s horrible report of only 34K new jobs and its subsequent downward revision to 11K, the June report MUST be considered suspect.

So think about this. If a company is worried about its future, doesn’t it seem strange to pay on average, 25 times earnings to buy back its stock? If they were buying back stock at 10-12 tries earnings, I could understand. But at 25 times earnings, buying back shares is not a strange strategy, it’s crazy!

It’s a strategy that can support the price of the stock for a while, but longer term, it’s not something that will lead to actual growth. I also believe it’s a very risky strategy. Share buyback programs and cost cutting measures are temporary accounting tricks. They make the price of a stock seem attractive to unsuspecting investors, especially seniors, who are being forced into the stock market because they need income (dividends). But eventually, if companies are going to keep their share price supported, they will have to show profits produced by real growth. With earnings season about to begin next week, and an overbought market, it should be interesting to watch what what happens as these companies report.

Protect yourself.

That’s what I’m doing,

The Professor