Hello Everyone,

As stated on the Bartometer on October 10th we were getting Buy signals, and the market was oversold and a good buy at that time. On November 10th, I noted that the market was too overbought and not to put any substantial money into the market. From that point until now the markets fell 5-10%. This month we have dropped to a point where the market is getting cheaper but not enough to start to invest large amounts of money into the market yet. Dollar cost averaging is fine, but not large amounts of money. There may be a Santa Claus that usually, but not always starts on the 15th of December. With COVID and inflationary problems, this may or may not come to fruition.

What caused the problem when the market is normally in seasonal strength? Omicron, (the new COVID variant), the Federal Reserve tightening money supply, and the market was 34% overvalued that Both Dr. Robert Genetski and I have been saying for months. In addition, the stocks which have been the best performers this year have been the mega large cap stocks like Apple, Microsoft, Google, Energy, Financial and more and the worst stocks have be the Very Aggressive stocks that were up so much last year like Zoom, DocuSign, Shopify etc. Investors, short term, have been more interested in earnings and reasonably valued stocks than stocks with aggressive revenue growth and high valuations. I still like the aggressive stocks but they are more volatile. The market is now overvalued 30% based on earnings and interest rates.

The economy is doing relatively very well and should continue to do so for a while, but next year I can see the economy having a harder time with earnings growth expected to grow 7-9%. Next year I see interest rates rising and the stock market rising 6-9% possibly, but there could be a monkey wrench thrown in the mix if inflation and interest rates rise more dramatically. In light of this I, am looking at BUFFERED ETFs (Exchange Traded Funds) that give the investor a cap on the upside. These are investments that cap the upside of the market, and give you a buffer on the downside. So, for example, if the market goes up 10%, you make 7-8%, but if the market goes down 15%, you don’t lose anything. If the market falls more than 15%, like 20%, you would lose 5%. These are interesting to me now because we again have to look at risk versus reward. What makes these ETF’s of more interest is that these are one year ETF holds.

Energy investments, financial stocks, reasonably valued stocks, technology still look okay for investments and I still like floating rate bonds if the economy is doing well during this period of inflation. Inflation protected bonds also do very well in an inflationary environment. Long term, 5 to 10 years, it’s about artificial intelligence, electric vehicles, technology and more. These are high risk, but high potential growth. In 2022, investors should be looking at more value and growth at a reasonable price.

Listed below are some of the INDEXES for both the equities and interest rate markets. The source is Morningstar.com up until December 4, 2021.

Dow Jones +14.94%

S&P 500 +22.47%

EQUAL WEIGHTED S&P 500 +22.4%

NASDAQ Aggressive growth +22.5%

Large Cap Value +19.75%

I Shares Russell 2000 ETF (IWM) Small cap +10.21%

Midcap stock funds +18.4%

International Index (MSCI – EAFE ex USA +7.22%

International Emerging Markets -4.91%

Financial stocks +30.6%

Energy stocks +50%

Healthcare Stocks +14% Investment Grade Bonds (AAA) Long duration -1.5%

High Yield Merrill Lynch High Yield Index +2.19% Floating Rate Bond Funds +3.77%

Short Term Bond -1.0%

Multi sector bond funds +2.4% Gold -6.58% 10 year Bond Yield 1.34% Moderate Fund +9.0% Average Disruptor Fund Aggressive growth -1 to -37%% big drop last month

Dr. Robert Genetskis Economic Excerpts

Market Outlook

Stocks moved sharply lower this week as popular indexes fell 2½% to 5½%. Large cap indexes were down 3%, while small caps fell 5%.

The main cause appears to be the emergence of Omicron, the latest COVID variant. Research worldwide shows lockdowns to be they are the worst of all responses, both in terms of overall impact on health as well as the economy.

Unfortunately, our health officials have not used either science or logic in dealing with COVID. As a result, there is no telling if they will now behave any differently. The fate of economy and, therefore the stock market, remains in the hands of what has been incompetent policymakers. It’s doubtful we’ll see lockdowns, but predicting their response is difficult.

The good news for stocks is the Fed continued to pour money into the economy in November. This will boost stocks, spending and inflation well into next year.

Although Fed Chair Powell indicated the Fed could halt purchases of securities before mid-year. This policy change is unlikely to slow the Fed’s stimulus.

Technical stock market indicators are more negative than positive. Yesterday, all of the major indexes closed above key resistance levels, which is certainly positive. However, trading volume has been lower on up days and stronger on down days, the opposite is true in strong, healthy markets.

Offsetting pressure from more money sending stock prices higher to concerns over the government

A Look Back Today’s employment report indicated private payrolls increased by 235,000 in November. Even so, the number of jobs remains 2% below its pre- COVID peak. Average hourly earnings rose at a 10% annual rate.

Economic Fundamentals: neutral

Stock Valuation: S&P500 over-valued 3

Economic Fundamentals: neutral

Stock Valuation: S&P500 over-valued 30%

Monetary Policy: expansive

Recommended Stock Exposure: 80%

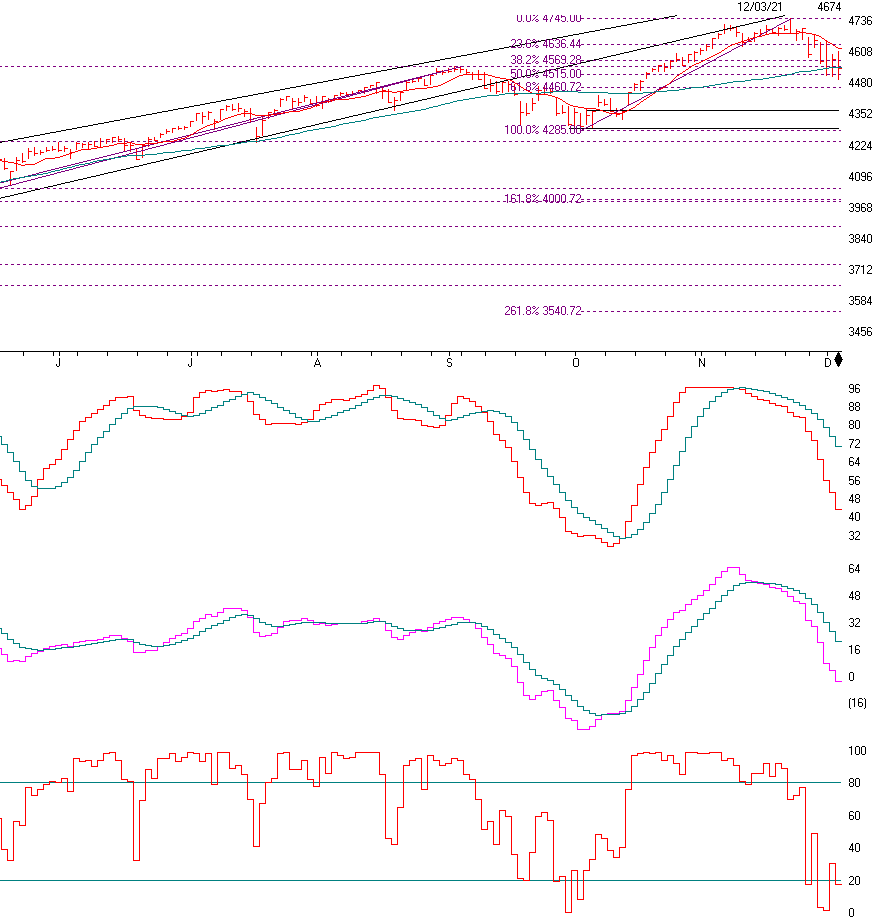

Above is the S&P 500, the index of the largest blue chip stocks that are based on market value. I have been putting in the short term buy and sell arrows on the chart as you can see on the left. As you can see, there were two Sells in late August, two Buy signals in early October 10th and two Sell signals in mid to late November. On November 10th we were still on BUY–Hold signals but I said do not Buy because the market technicals were too overbought and extended as seen by the indicators above.

The first one was the SK-SD Stochastic chart. Last month I said the SK-SD Stochastic was over 88 and is now too over bought and not said not to buy. On October 10th I said the SK-SD Stochastic was under 32 and the market was cheap and we were giving BUY signals. Now with the selloff we are now getting near the 32 zone again where the market is starting to get over sold and it MIGHT be putting in a BUY zone. We need to analyze every day.

The next chart is the MACD, or Momentum model. This also shows when momentum is topping and turning north or south. When the red crosses above the blue it’s a preliminary BUY, and when it crosses from the upside below the blue line it’s a preliminary Sell. This is one of 15 things I look at to determine a buy or a sell signal.

Stochastics is the last chart and the Buy signal is given when the red line goes above the 20 and the sell is when it crosses above the 80 and that’s what it gave on 11.22.21 on HIGHER volume. We got short term sells on that day. See the red bars.

Now that the S&P is down and you want to know where there might be a short term bottom. Let’s look at where there could be Buying support. The S&P has buying support levels at: 4515, 4460, 4305, (200 day moving average), and 4285, and 4001.

CHART SOURCE: AIQSYSTEMS.COM

Support levels on the S&P 500 area are 4515, 4460, 4305, 4285, and 4001. Resistance is at 4636

NASDAQ support levels are 15,068, 14,857, 14,174 and 13,069

These may be safer areas to get into the equity on support levels slowly on the accumulation areas.

THE BOTTOM LINE:

After the market rallying for most of the year, it sold off hard over the last three weeks, especially the small to mid-cap and the very aggressive stocks. Over the long term, (5 years to 10 years) these stocks exhibit 20- 40% per year revenue growth and are the future, but are very volatile. The market is still in seasonal strength, but the COVID situation and inflation problems are rearing their ugly heads. I like large cap growth as well as small value and financials. Artificial intelligence should be one of the fastest growing sectors over the next 10 years

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

Contact information:

Joe Bartosiewicz, CFP®

92 High Street

Thomaston, CT 06787

Securities and advisory services offered through Sagepoint Financial, Inc. (SPF), member FINRA/SIPC. SPF is separately owned and other entities and/or marketing names, products or services referenced here are independent of SPF. 800-552-3319 20 East Thomas Road Ste 2000 Phoenix AZ 85012

Technical Analysis is based on a study of historical price movements and past trend patterns. There is no assurance that these market changes or trends can or will be duplicated shortly. It logically follows that historical precedent does not guarantee future results. Conclusions expressed in the Technical Analysis section are personal opinions: and may not be construed as recommendations to buy or sell anything.

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.