September 12, 2021

Hello Everyone,

I hope you all had a great summer and did some of the things you wanted after a long period with Covid. I am confident that our lives with get to some semblance of normalcy soon.

The market is now in the seasonally weak period of the year and I expect a continued short term volatility in the market. September is usually a volatile time of the year with October bottoming. November through January is usually a seasonally strong period. The Dow Jones has closed below the 50 day moving average a negative indication in the market. The S&P 500 sold off Friday and it is once again at the bottom of the trend line. My AIQ models are on a short term sell signal over the last 2 weeks and the Dow Jones support level is broken. Any close below 4413 on the S&P will get me Very Cautious on the market and short term there could be a break in the trendline pattern and start a correction in the market. Long Term I am very bullish but Short term traders get in and out of this market very quickly. They shift money in herds, buying and selling with large pools of money creating short term spikes in volatility. Long term investors need to stay the course and right now Volatility can cause declines in the portfolio. If you are over the age of 60 or nearing or in retirement I would reduce equities by 5-10%% if you are concerned about short term potential volatility that may happen. The markets are now 29% overvalued.

Earnings are still coming out better than expectations and interest rates should stay low for a while longer so any decline in the markets allow us to buy cheaper shares to redeem over the longer term. Expect Volatility.

Listed below are some of the INDEXES for both the equities and interest rate markets.

Dow Jones +14.58%

S&P 500 +19.6%

EQUAL WEIGHTED S&P 500 +21.65%

NASDAQ Aggressive growth +20%

Large Cap Value +18%

I Shares Russell 2000 ETF (IWM) Small cap +13.4%

Midcap stock funds +17%

International Index (MSCI – EAFE ex USA +10%

International Emerging Markets +2%

Financial stocks +28%

Energy stocks +28%

Healthcare Stocks +17%

Moderate Mutual Fund Investment Grade Bonds (AAA) Long duration -2.5%

High Yield Merrill Lynch High Yield Index +3.5%

Floating Rate Bond Funds +3.51%

Short Term Bond +.9%

Multi sector bond funds +2.9%

Gold -6.3%

10 year Bond Yield 1.23%

Moderate Fund +8.7%

Average Disruptor Fund Aggressive growth -2%

Dr. Robert Genetskis Economic Excerpts

Market Outlook

The market continues to ignore the Delta variant, supply-side constraints and the debacle in exiting Afghanistan. None of these potential headwinds were able to withstand the Fed Chairman’s assurance there would be no hike in interest rates until after next year’s election.

Chairman Powell said inflation is under control. He also indicated rising prices were the result of almost anything but the Fed pouring more money into the economy.

This is typical Fed speak. The Fed creates money with abandon, takes credit for a booming economy, then blames inflation on everything else. It’s called “modern monetary theory,” but it’s as old as money itself. Based on early business surveys, I had expected some of the economic news for August would show brief signs of a slowdown. However, the ISM survey for manufacturing indicates business was strong and new orders are signaling further strength.

The S&P500 is now 29% above its fundamental value. So far, the Fed’s monetary explosion is carrying stocks well above their fundamental value.

So long as the Fed is able to keep interest rates well below their normal levels, stock prices will remain elevated.

A Look Back

August’s report shows only 243,000 private sector payroll jobs were added in August, well below the 800,000 additions in June and July. The smaller job gains are consistent with business surveys showing little or no job gains. The amazing thing is businesses are still rapidly expanding output in spite of employing 3½% fewer workers than at the pre-Covid peak.

Economic Fundamentals: positive Stock Valuation: S&P500 over-valued 29% Monetary Policy: expansive Recommended Stock Exposure: 85%

The S&P 500

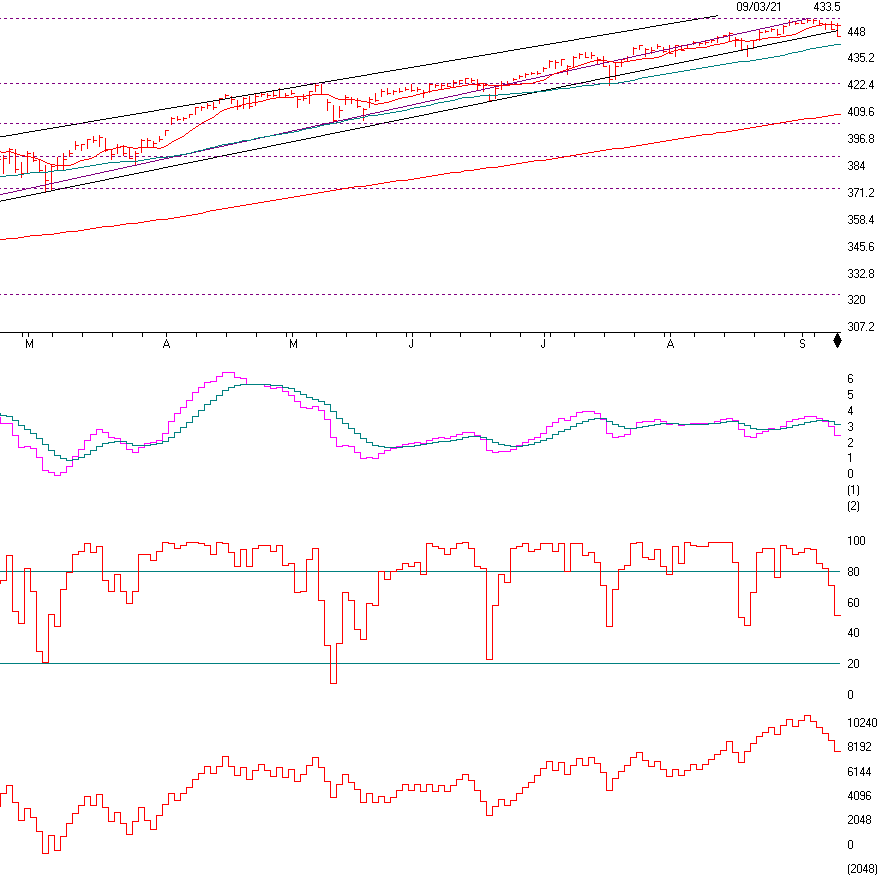

The S&P 500 is above. If you look you can see that the S&P has broken the trend-line (negative) and is approaching its 50 day moving average. This is short term negative and I will get VERY Cautious if it breaks the 4413 level on a close. The Dow Jones Average closed below its 50 day moving average. This is why I am getting Cautious and believe some of you should be taking profits and or rebalancing if you have too much money in the stock market. September is usually a volatile month, but any decline of significance and I will get Bullish as I believe a major selloff would could be a major Buy if you are a long term investors. If you are trading stocks, then I would make sure your companies are solid with great earnings, revenues and balance sheets. Call me with questions but right now I am Cautious to possibly Very Cautious if 50 day moving average is broken on a close.

The graph under the price chart is Momentum and as you can see the pink line closed below the blue line, a negative.

The next chart is Stochastics. This shows over bought and oversold indexes. Sell signals are given when the Stochastics breaks below the 80 as it is showing now.

On Balance Volume is trending lower. This shows higher volume on sell offs. This is a negative.

CHART SOURCE: AIQ SYSTEMS.COM

Support levels on the S&P 500 area are 4413, 4224, 4010, and 4000.

These may be safer areas to get into the equity on support levels slowly on the accumulation areas.

THE BOTTOM LINE:

Long term I am Bullish but over the VERY SHORT TERM I am getting Cautious to Very Cautious. As I stated last month, The August to October season tends to be seasonally weak and September tends to be the worst. The market is 29% overvalued, we are on short term sell signals and the Dow Jones has broken below its trend-line and its 50 day moving average. The NASDAQ looks ok but if the S&P 500 closes below it 50 day moving average over the next few days it can easily drop another 3-6% to the 4222 next level. If that breaks then the next level is its 200 moving average currently at 4090.

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

92 High Street

Thomaston, CT 06787

Securities and advisory services are offered through SagePoint Financial, Inc. (SPF), member FINRA/SIPC. SPF is separately owned and other entities and/or marketing names, products or services referenced here are independent of SPF. 800-552-3319 20 East Thomas Road Ste 2000 Phoenix AZ 85012

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30-50% of its portfolio in different categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment-grade rating. The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating-rate coupon U.S. Treasuries, which have a maturity greater than 12 months.