March 8, 2021

Hello Everyone,

Over the last few weeks the markets have drifted lower with the NASDAQ actually negative for the year. The rest of the non tech sectors have performed relatively well as seen on the chart below. As investors are looking for continual growth in the overall economy—the sectors impacted hardest by Covid have started to bounce back. Cruise ships, manufacturing, and airline stocks are all seeing short term gains strengthened by the stimulus plan, increase in Covid vaccination distribution, and hope of future increased earnings. The large cap growth stocks like Apple, Amazon, Tesla, and Microsoft have flattened over the last 8 months. The small to mid-cap stocks, energy, and financials have kept the market upright and are still reasonable to be invested in with proper allocation. Energy stocks however, may continue to perform relatively well over the short term, longer term I don’t see a lot of growth as President Biden and the other nations strive to eliminate the need for fossil fuels replacing them with electric, solar, and alternate ways of generating power. In addition, financial stocks also have been doing well and should continue to perform as long as the economy is doing well and interest rates are rising. Even though the market is about 13% overvalued and in the short term could fall; the economy should rise throughout the rest of the year giving us a decent buying opportunity if the market falls. Interest rates should still push higher over the longer term, but short term the interest rate rise may stall growth.

Some of the INDEXES of the markets both equities and interest rates are below. The source is Morningstar.com up until March 07, 2021.

YTD

Dow Jones +3.33%

S&P 500 +2.61%

EQUAL WEIGHTED S&P 500 +4.7%

NASDAQ Aggressive growth -1.61%

Large Cap Value +7.0%

I Shares Russell 2000 ETF (IWM) Small cap +11.05%

Midcap stock funds +7.52%

International Index (MSCI – EAFE ex USA +2.5%

International Emerging Markets +4%

Financial stocks +14%

Energy stocks +39%

Healthcare Stocks -1.0%

Moderate Mutual Fund Investment Grade Bonds (AAA) Long duration +.5%

High Yield Merrill Lynch High Yield Index +0.2%

Floating Rate Bond Funds +1.4%

Short Term Bond +.2%

Multi sector bond funds -.4%

Gold -11%

10 year Bond Yield 1.62%

As you can see above, the NASDAQ and the tech stocks, the leader over the last year is down for the year. They may be down, but don’t count them out. That sector is the growth engine of the world. They just need a rest short term.

Classicalprinciples.com and Robert Genetskis Excerpts

Market Outlook

Stock prices moved decisively lower this past week as all 5 key indexes lost ground. The Nasdaq and QQQs fell 3% bringing both indexes to 10% below their recent highs. Other indexes fell 1%-2½%.

In his analysis a month ago, my technical guru, Joe Bartosiewicz CFP, warned of potential problems due to a technical formation. Stocks have already gone through some of Joe’s support areas with the S&P500 below its 50-day average. His latest key levels for support are the 12,500 vicinity for the Nasdaq and 3671 for the S&P500.

Economic news remains mostly positive. Investors now appear concerned over too strong a recovery, higher inflation and increases in longer-term interest rates.

Current policies aren’t helping. Both Fed Chairman Powell’s insistence on further monetary ease and the pork-loaded $1.9 trillion “stimulus” bill are feeding concerns over higher inflation.

At yesterday’s close, the S&P500 was overvalued by 13%. As a result, stocks are still vulnerable to further declines. I continue to expect the Fed’s monetary ease to provide a tailwind for stocks to keep the S&P500 above its fundamental value. However, when psychology turns negative, there is no way to know how far a correction will go.

As for longer-term interest rates, they remain well below their fundamental level. We are at the beginning of what I expect will be a major upward move in long-term rates. Fixed-income portfolios should remain very defensive.

A Look Back

Today’s job report shows a gain of 465,000 private jobs in February, 355,000 of these were in leisure and hospitality. In spite of the gains, the number of jobs remains 6% below its peak of a year ago. The good news for jobs is also evident in initial unemployment claims. They averaged 791,000 in February, 50,000 less than the previous two months.

Stock Valuation: S&P 500 13% Overvalued

Economic Fundamentals: Positive

Monetary Policy; Highly Expansive

.

Source: Classical Principles.com

NASDAQ

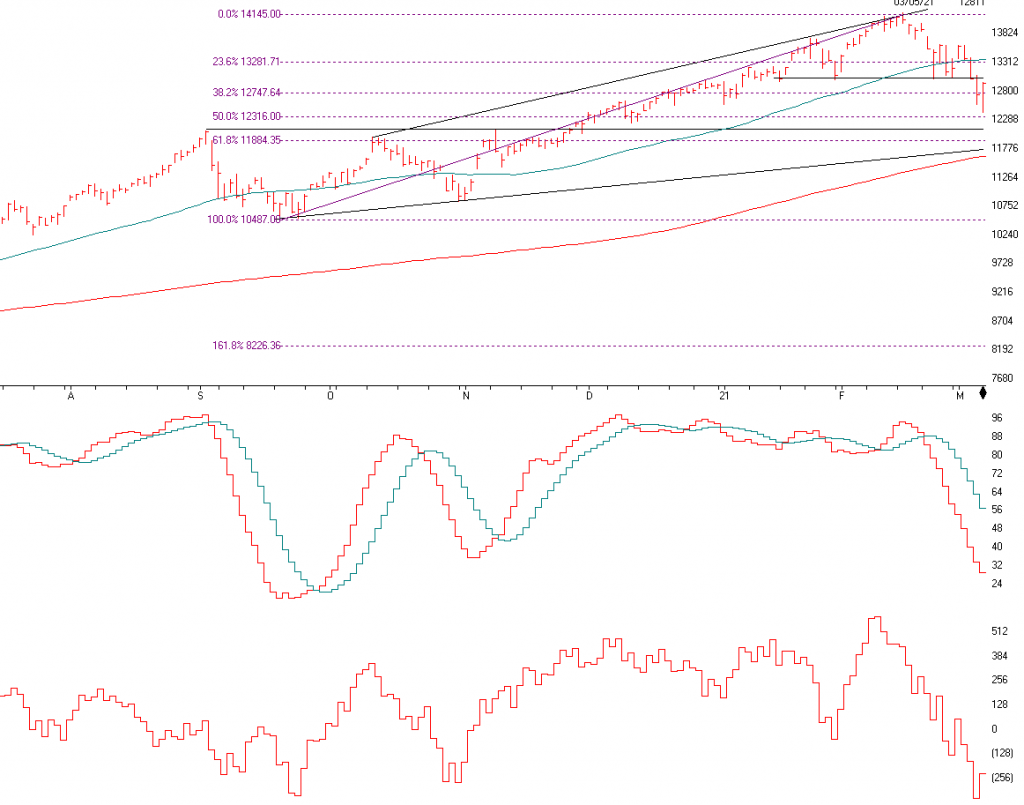

This is the index that contains Apple, Microsoft, Google, Tesla, and the aggressive tech stocks in general. Last month I said that the markets were overbought and that we had a Rising Wedge pattern. Not only a rising wedge but a Head and Shoulders top, with the neckline at 13015. If the NASDAQ closes above 13315 and stays there for 2 plus days, I will get more positive. Friday, AIQ gave a short term Buy signal on the daily charts. I am not totally convinced yet. I want to see it close above the 50 day moving average, 13315, for a day or two. There is support on the NASDAQ at 12,316(area), 12,104, 11,900, 11,743, 11,618, and 10,801

SK-SD stochastics is now somewhat Oversold, so long term investors may want to nibble here but there could be a lot more on the downside to come as it’s not very oversold.

The Advance Decline line is the number of stocks going up compared to the number of stocks going down on a running total. As you can see to the left, there are a lot of stocks in the NASDAQ that are falling. This year’s rally has been powered by the energy stocks, value and financials. This is why we diversify.

As I see it, interest rates have a lot of internal pressure to rise, meaning long term bonds can continue to get hit, but the economy should continue to get better and that should help stocks in general.

Support levels on the S&P 500 area are 3723, 3694, 3671, 3594, RESISTANCE on the S&P is 3887

NASDAQ Support, 12,214, 11,900, 11,618, and 10,801

Dow Jones 30310, 29782, 29217, and 29017

These may be safer areas to get into the equity markets on support levels slowly on the accumulation areas.

THE BOTTOM LINE:

The market has sold off over the last month, especially the aggressive tech and NASDAQ stocks. Value, energy, and financial stocks continue to rally this year. I still like financial and energy stocks, but not for long term holds as fossil fuels are reduced and even eliminated. Technology should do well over the long term and if the tech sector continues to sell, I will start to buy them myself as long term they are in the sweet spot. The Small Stocks have performed great this year and I think the Covid stocks that were hurt last year, like the restaurants, parks, cruise ships and more will come back as the economy gets stronger. Diversification is now important as the first 10 months of the recovery has been all large growth.

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

Securities and advisory services offered through SagePoint Financial, Inc. (SPF), member FINRA/SIPC. SPF is separately owned and other entities and/or marketing names, products or services referenced here are independent of SPF. 800-552-3319 20 East Thomas Road Ste 2000 Phoenix AZ 85012

Technical Analysis is based on a study of historical price movements and past trend patterns. There is no assurance that these market changes or trends can or will be duplicated shortly. It logically follows that historical precedent does not guarantee future results. Conclusions expressed in the Technical Analysis section are personal opinions: and may not be construed as recommendations to buy or sell anything.

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30-50% of its portfolio in different categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment-grade rating. The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating-rate coupon U.S. Treasuries, which have a maturity greater than 12 months.