How to Read, Confirm, and Trade the Signals

AIQ’s Market Timing Expert Ratings compress hundreds of technical conditions into a single, actionable score. Use 95+ up or down ratings as “of-notice” events, then confirm direction with the Price Phase indicator before acting. This simple two-step process keeps you aligned with the dominant swing while filtering many head fakes.

What the Market Timing Expert Rating Really Is

Under the hood, the AIQ Expert System evaluates ~400+ indicator states through an inference engine (decision-tree style) and outputs a daily market rating—from neutral to powerful up/down signals. You’ll also see these ratings plotted directly on historical charts in TradingExpert Pro.

Why that matters: Instead of juggling dozens of internals, you get a unified, explainable read of market conditions that has been kept methodologically stable for years (no goal-post shifting or perpetual re-optimization). That stability helps make the historical behavior of the signals more comparable across cycles.

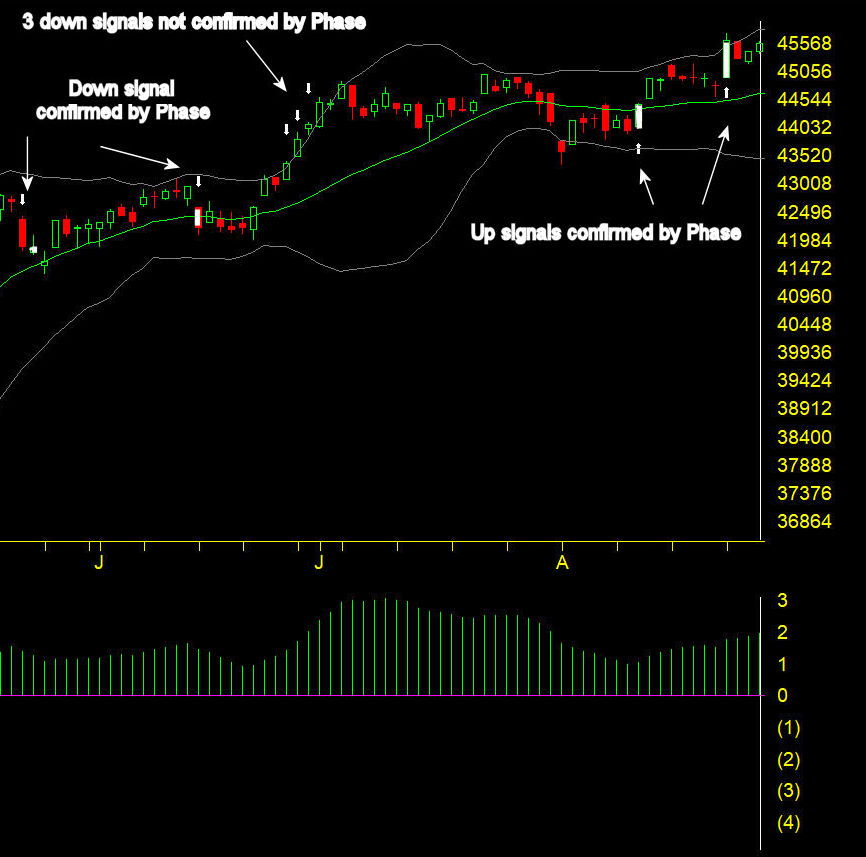

AIQ Market Timing signals with confirmation by Phase Jan – May 2025

The Confirmation Key: AIQ’s Price Phase Indicator

AIQ explicitly recommends using the Price Phase Indicator (“Phase”) as the primary filter for Expert Ratings. When Phase direction agrees with a high Expert Rating signal, the signal is considered confirmed. In other words:

- Strong Up Rating (≥95) → look for Phase turning up or already rising to confirm.

- Strong Down Rating (≥95) → look for Phase turning down or already falling to confirm.

This is purposeful: Expert Ratings often fire early—giving you a heads-up—while Phase helps you avoid acting too soon. Think of Ratings as the alert and Phase as the green light.

Interpreting the Score: When Does “High” Mean “Actionable”?

Per AIQ’s guidance, 95 or greater to the upside or downside is the zone “of notice.” That’s when you should lean in, check Phase, and consider entries/exits or hedges—not when readings are middling or neutral. Most days are neutral; the edge lives in waiting for 95+ and confirming with Phase.

AIQ Market Timing signals with confirmation by Phase May – Aug 2025

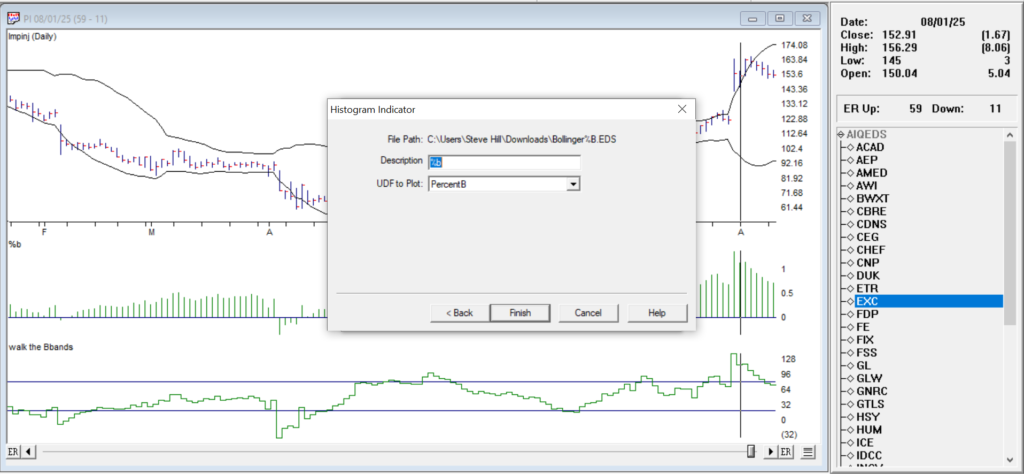

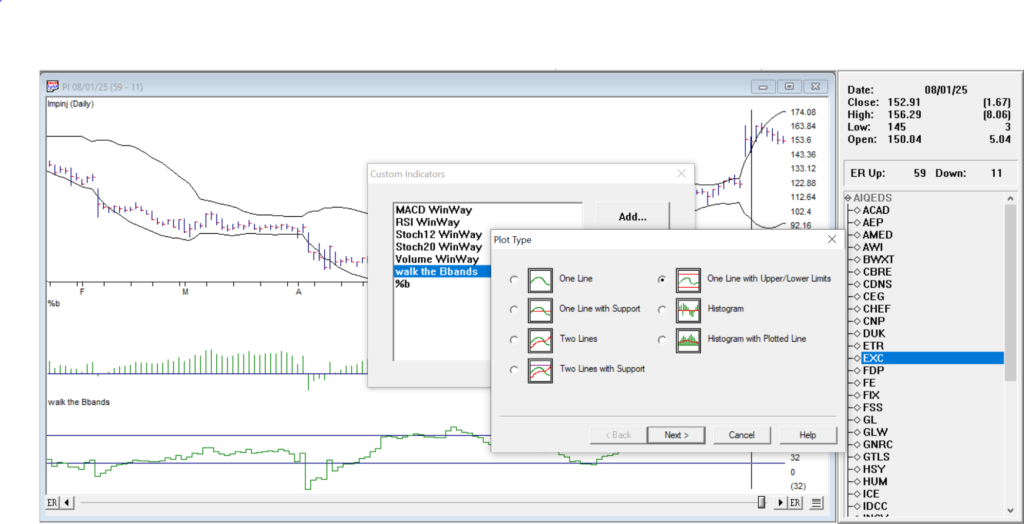

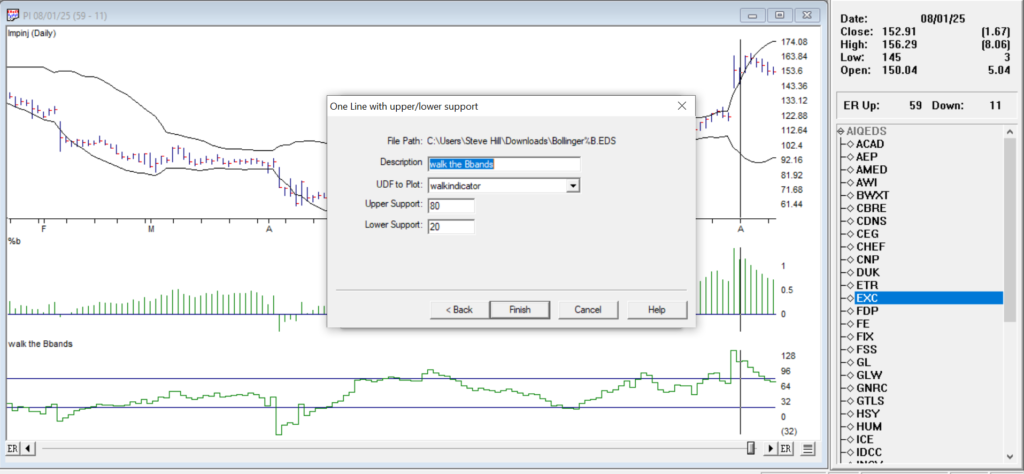

Where to See It in TradingExpert Pro

- On your AIQ Main Menu, select Market Charts, and plot Price Phase in a lower pane. This combination is designed for side-by-side evaluation.

- If you prefer a visual “state” view, Heikin-Ashi-mode bars with Phase underneath are often used in AIQ’s examples to highlight trend persistence.

How to Read the 2025 Chart (Step-by-Step Playbook)

- Spot the Spike

Scan for 95+ up/down ratings. Put a small flag on each to review. - Check Phase Direction

- If the rating is Up (≥95), is Phase rising or just turned up?

- If Down (≥95), is Phase falling or just turned down?

Match = Confirmation. No match? Put it on watch—often the earliest ratings need a bar or two before Phase confirms.

- Plan Entries/Exits

- For confirmed Up: consider scaling into risk-defined long exposure, tightening shorts.

- For confirmed Down: consider trimming longs, or tactical shorts—again, with risk clearly defined.

- Manage the Hold

Historical AIQ studies often show swing-length holds rather than ultra-short scalps (average holds are one week to several weeks), but your trade horizon should match your strategy.

Best Practices (That Save You from Heartache)

- Don’t front-run Phase on big ratings. Early feels clever until it doesn’t. Let the filter do its job.

- Treat 95 as your attention alarm. Below that, conserve focus; above that, prepare plans.

- Neutral = No edge. Most days are noise; your edge is in selectivity.

Common Questions

Q: Are the rules curve-fit over time?

A: AIQ deliberately keeps the rating calculation stable, avoiding constant re-tuning. That consistency is part of why the historical behavior is analyzable.

Q: Is Phase the only valid confirmation?

A: It’s AIQ’s primary confirmation tool for Expert Ratings and the one used in the official “confirmed” flagging. You can add your own overlays, but Phase remains the recommended filter.

Q: Do signals work on intraday charts?

A: The Market Timing ratings are generated daily. You can time entries intraday after a daily confirmation, but the signal itself is evaluated on the daily close framework.

Final Word

AIQ’s Market Timing Expert Ratings give you clean, explainable signals—and the Price Phase indicator gives you the discipline to act only when odds tilt in your favor. Use the 95+ threshold to focus, Phase to confirm, and your risk plan to stay in the game when it counts.