MACD divergence is a tried and tested technical tool. If you look at the daily price chart of Verizon below, you can clearly see the recent high on 4-12-2013. Note the MACD is well below the indicator peak back in the middle of March.

Category Archives: Uncategorized

Market Update Thursday April 4, 2013

|

by Hank Swiencinski, AIQ TradingExpert Pro client for

over 20 years, founder of ‘The Professor’s One Minute Guide to Stock Management’

AIQ extends its congratulations to Hank for presenting

a really excellent seminar on Saturday March 9, 2013. if you attended and have some additional feedback please e-mail Steve Hill

The markets appear to be marking time, waiting for tomorrow’s jobs report.

I started buying shares of DXD when the Dow popped this early morning. Given that I believe the top of wave ‘a’ is somewhere near the 14,650 level, I believe the risk-reward is favorable for shorts at or near these levels.

Here’s the deal: If tomorrow’s jobs report turns out to be poor, it could trigger an impulse wave in wave ‘b’ down. On the other hand, If the jobs report turns out to be positive, I believe the pop will just give me another opportunity to add to my shorts. That’s what I mean by a favorable risk-reward ratio.

Right now there is no trend going on. The Dean is still positive, and Emeritus is still silent. The Professor is mixed with an equal number of Buys as Shorts (4). It’s starting to look like today’s retracement is part of a wave 2 in the ‘b’ wave.

I don’t expect my algorithms to become active until the DIA starts to trade below 145.

So for the rest of the day, I plan to continue to look for and accumulate a few short positions. I’m NOT getting aggressive yet. I’ll only do that when the DMI on the Dow turns negative. However, because I believe the upside potential is limited now that we have reached my targets, I will start holding my short positions overnight.

I’m now long DXD and short ORCL.

TWID,

h

|

|

All of the commentary expressed in this site and any attachments are opinions of the author, subject to change, and provided for educational purposes only. Nothing in this commentary or any attachments should be considered as trading advice. Trading any financial instrument is RISKY and may result in loss of capital including loss of principal. Past performance is not indicative of future results. Always understand the RISK before you trade.

|

Low Frequency Trading

The AIQ code based on Ron McEwan’s article in the March issue of Stocks & Commodities, “Low-Frequency Trading,” is provided at the following website: www.TradersEdgeSystems.com/traderstips.htm.

The cumulative indicators on the advances and declines for the NYSE are provided in the first section of code that follows. However, I have never liked cumulative indicators because results can vary depending on where the accumulation is started. I do not recommend using the first code set below that replicates the author’s indicator because it runs so slowly that you will think your computer is frozen. Thus, I coded an alternative that uses the built-in advance-decline (A/D) line and then takes a moving average of the built-in A/D line. This version runs quickly and probably gives similar results.

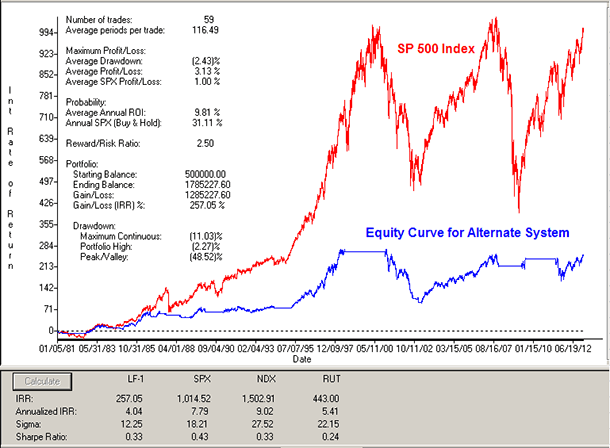

I did not test the first coded version. I tested my second code set as a timing system on the S&P 500 ETF (SPY) from 1981 to 2/12/2013 (Figure 7). As with most timing systems, the risk was reduced based on a lower sigma than that of the markets and the return was also less than just buying and holding the SPY for the test period.

The code and EDS file can be downloaded from

www.TradersEdgeSystems.com/traderstips.htm.

The code is also shown below.

!LOW-FREQUENCY TRADING

!Author: Ron McEwan, TASC April 2013

!Coded by: Richard Denning

!www.TradersEdgeSystems.com

!INPUT:

advMAlen is 252.

!ABBREVIATIONS:

C is [close].

OSD is offSetToDate(month(),day(),year()).

!AUTHORS INDICATOR AND SYSTEM (processes very slowly-see alternate below):

DaysToStart is min(advMAlen,scanany(month()=02 and day()=05

and year()=1980,252*50) then OSD).

NYadv is TickerUDF(“DJIA”,[Adv Issues]).

NYdec is TickerUDF(“DJIA”,[Dec Issues]).

ADVpctTot is (NYadv-NYdec) / (NYadv+NYdec) * 1000.

ADVcumPct is sum(ADVpctTot,^DaysToStart).

ADVcumPctMA is simpleavg(ADVcumPct,252).

HD if hasdatafor(advMAlen +10) > advMAlen.

Buy if ADVcumPct > ADVcumPctMA and HD.

Sell if ADVcumPct < ADVcumPctMA.

!ALTERNATE TO ABOVE (due to processing speed recommend that this one is used):

ADline is tickerUDF(“DJIA”,[AD Line]).

ADlineMA is simpleavg(ADline,252).

BuyAlt if ADline > ADlineMA and HD.

SellAlt if ADline < ADlineMA.

Market update 03/13/2013 and kudos

|

by Hank Swiencinski, AIQ TradingExpert Pro client for

over 20 years, founder of ‘The Professor’s One Minute Guide to Stock Management’

AIQ extends its congratulations to Hank for presenting a really excellent seminar on Saturday March 9, 2013. if you attended and have some additional feedback please e-mail Steve Hill

The Dow rose 2 points, closing at 14,450. The Dow got as high as 14,478 before pulling back. Volume was low again, coming in at 90 percent of its 10 day average. There were 244 new highs and only 17 new lows.

The A-D oscillator fell to 14.9 during yesterday’s trading. If we get a down day today, it’s likely that the oscillator will turn negative, meaning that most stocks on the NYSE are starting down trends. Coming at this point in the pattern, there is a good chance that wave ‘b’ down could be starting.

There is also a possibility that a pullback today could be part of a small corrective wave before one final push higher completes the ‘a’wave. At this point it’s hard to tell. And that’s why we will need to keep an eye on the Dean’s List. A small pullback today could turn out to be a false alarm. I don’t want to get too negative until I see a few of those positive ETFs start moving down or dropping off the Dean’s List.

The List remains very strong and the indicators on the cockpit remain positive. However the P-volume, which is one of our three PT indicators remains negative. It has been diverging from price ever since this leg of the current rally started on 25 February. It’s warning us not to get to comfortable.

If you get a chance today, take a look at the P-volume on the DIA, and while you’re at it check it on the Nasdaq (QQQ) as well. It’s actually pretty scary. This negative divergence is also evident on all of the indicators I use to measure market breadth, like the Summation Index, Hi/Lo Oscillator, Advance Decline Indicator, and VA Percent Indicator. They’re all diverging negatively, which is a warning. The Hi/Lo oscillator is actually lower now than it was on 1 February, when the Dow was at 14,009. It’s telling us that fewer and fewer stocks are participating in this rally. Always be careful when the Generals lead and the troops don’t follow.

We still have a ‘relatively’ small change (13.78 points) from the A-D oscillator on the board from two days ago. And because of this we’ll need to pay attention to any decline. There is still a possibility of a Big Move.

Emeritus was pretty quiet again last night, with only one stock being highlighted, and that was a short. This is the second day in a row that he hasn’t had much to say. I would expect that IF the market starts to turn negative, he will start to highlight a few more shorts for the Honor Roll. But right now, he’s silent…both on the long and short side.

Once again, with weak internals, I’m just watching for the markets to start to roll over. I believe the upside potential is limited at this point, so I’m not initiating any new long positions now. If we start out negative today, I will be looking to scalp a few shorts as I’m waiting. I will also be posting the Dean’s List after 1pm today to see if there are any changes. And if the market starts to trade lower, I will also be running Emeritus to see what he has to say as well. If he kicks out 1-2 shorts, I’ll continue to watch. But IF he starts to highlight 6 or more shorts, that will get my attention.

I’m on the sidelines.

That’s what I’m doing,

h

PT Class at UNF tonight.

|

|

All of the commentary expressed in this site and any attachments are opinions of the author, subject to change, and provided for educational purposes only. Nothing in this commentary or any attachments should be considered as trading advice. Trading any financial instrument is RISKY and may result in loss of capital including loss of principal. Past performance is not indicative of future results. Always understand the RISK before you trade.

|

Market Update March 1, 2013

|

by Hank Swiencinski, AIQ

TradingExpert Pro client for over 20 years, founder of ‘The Professor’s One Minute Guide to Stock Management’. AIQ will be hosting a full day seminar with ‘The Professor’, March 9, 2013 in Orlando, FL. More info CLICK HERE

The Dow rallied up to 14,149, then fell into the close, finishing down 20 points at 14,054. Volume was low again, coming in at 92 percent of its 10 day average. There were 214 new highs and 28 new lows.

The combination of low volume and a late day sell-off is not something you want to see if you’re short term Bullish. Institutions are usually the ones that trade late the day, and when the market sells-off in the last hour, it’s usually because the smart money knows something. If the market starts moving higher in the weeks ahead, watch how the market trades during the last hour. If we start to see more late day sell offs, it will be another warning sign that a we could be approaching a top.

There was a small change in the A-D oscillator yesterday, so we need to be on the lookout for a Big Move in price within the next 1-2 days.

It appears that yesterday’s early rally was the completion of wave 1 up of 5 up. If this is the case, then yesterday’s late day decline was the start of wave 2 down. This wave should have an a-b-c pattern to it, and it should complete within the next few days. After that, I would expect the markets to put together enough strength to test the June 07 high of 14,198.

I posted the Dean’s List two times yesterday to show how the List was changing by dropping QID and RWM, the two inverse ETFs that were on the List. But yesterday’s late day decline change all that, and both ETFs stayed on the List, producing mixed signals. So once again, I would call the List a cautionary yellow. The Dean is likely telling us that a wave 2 down is starting.

Yesterday I mentioned that I was only going to scalp trade, and that’s what I did during the rally. Five of the six stocks highlighted by Emeritus produced winning trades on the 5s. HAL and HP were both up over a point intra day.

The DMI on the Dow(DIA) and Nasdaq (QQQ) remains positive. However the Coach, my main Money Flow indicator, remains negative. The P-volume is also negative and diverging on both indexes. So we have mixed signals from the cockpit. In other words, we need to be cautious again with any trades we make today. BTW, after the wave 2 completes, we will need to watch the volume indicators during the wave 3 rally. If they don’t turn positive, it will be another major sign that the rally will be met with stiff resistance.

If you get a chance today, you might want to look at the P-volume on a Daily Chart of the DIA. Note how during the past year, as the Dow (DIA) made each successive rally high, the P-volume did not. Look at the rally going into last March, then into October, and finally how the indicator continues to diverge into the current rally. The P-volume is warning us that each new high is being supported by less and less volume. It’s warning us that the tank could be getting close to empty. It’s not a major problem now, but it could be in the future.

I won’t be doing a lot today. I really want to see how this likely wave 2 develops. If I see something that I want to scalp, I’ll post it during the day,. But otherwise I’ll be on the sidelines.

One thing we need to remember is that we have a small change in the A-D oscillator on the Board. So we could see a move of 100+ points within the next 1-2 days. I don’t believe we will see the Big Move today. But IF we do, I don’t want to be holding a lot of stock IF that move is down. On the other hand, IF the market does move a bit lower today, in preparation for a Big move up early next week, I want to have a few candidate stocks at the ready so I can get into them IF the market starts to move up. Remember, the next move up should be an impulse wave. And if the wave has enough strength to push through 14,198, we could easily see 14,500. on the Dow, possibly higher.

So today, I will be trying to identifying stocks for the next rally leg. Remember, when we see a retracement wave coming, we always plan so we can take advantage of the next move higher.

That’s what I’m doing,

h

|

|

All of the commentary expressed in this site and any attachments are opinions of the author, subject to change, and provided for educational purposes only. Nothing in this commentary or any attachments should be considered as trading advice. Trading any financial instrument is RISKY and may result in loss of capital including loss of principal. Past performance is not indicative of future results. Always understand the RISK before you trade.

|