When AIQ released StockExpert in 1987, the Expert Ratings were the foundation of the system. This release represented the first software product developed for personal computers that used Artificial Intelligence to signal equity movement. AIQ’s founder and knowledge engineer, Dr. J.D. Smith, chose to use expert system technology that was developed at Stanford University in the late 60’s. An expert system uses a knowledge based rule driven structure.

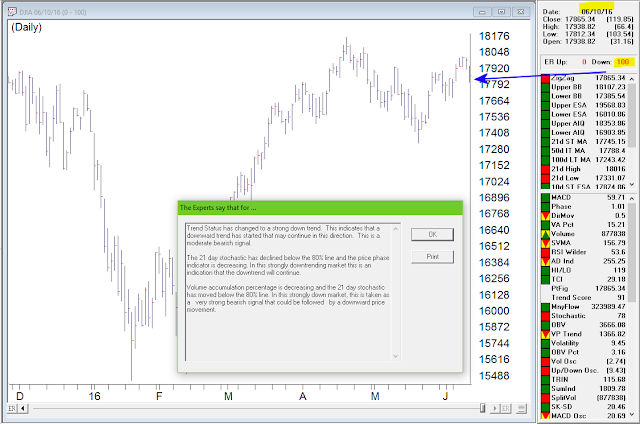

Dr. Smith tested hundreds of technical rules that had been published by respected analysts.Those rules that tested well were placed into a knowledge base of rules. Rules were weighted based on their effectiveness. When a series of bullish rules was triggered, an Expert Rating buy signal was generated. A series of bearish rules generated an Expert Rating sell signal.

| In this video Steve Hill explains the internal rules of the Expert System that generated the signal |

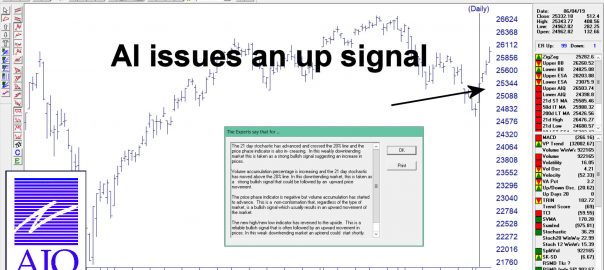

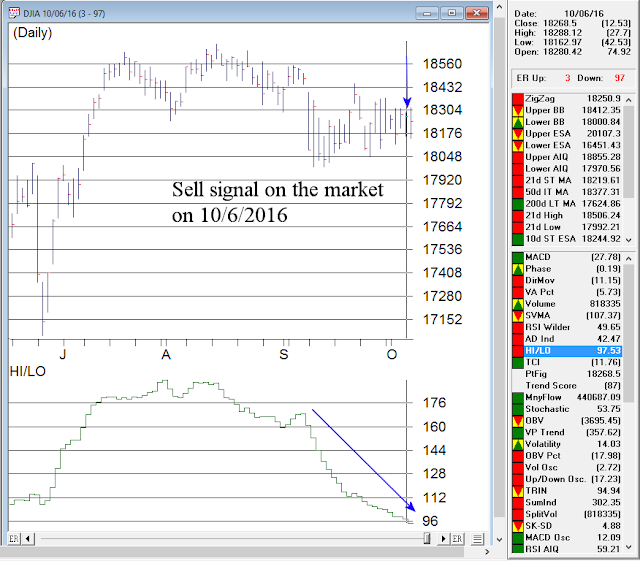

The sell signal that the AI system issued on April 18, 2019 presaged a 2000 point move down. Things have now changed. On June 4, 2019 the AI system issued a buy signal.