June 11, 2021

Hello Everyone,

On my Bartometer in December, I thought the S&P 500 would reach 4200 to 4400 this year. The S&P is now at 4247. My computer models are still relatively positive, but I am starting to show cracks in the dam. The stocks that were big winners last year, like the electric vehicles, the new internet of things, the super advanced genomics, innovation stocks that were up 120% or more are down for the year about 5-20%. The Value stocks continue their winning pattern, however, over the last couple of weeks the aggressive stocks are starting to turn as the Value stocks are now fairly valued. If you have disrupter stocks in your portfolio and are great companies then it is important to keep the fund or ETFs if they are good, as these are the companies that are the next big winners over the long term.

My Computer models are still on a longer term Buy-Hold, but now some are giving early warning Sell signals on the weekly chart that are not confirmed, but need to be watched. See page 3 on the S&P to keep your eye on the exit door when the market starts to look like it is topping out. Currently, the market is 27% overvalued.

As you know house prices are soaring and could continue for a little while longer as copper prices, lumber prices rise. But when interest rates start to rise and there is more supply on the market as the eviction and foreclosure moratorium is about over, then real estate prices should wain somewhat.

If the stock market sells off from here, you may want to add more to your stock portfolio, if you have a longer-term horizon. Please call me for guidance in the allocation of your 401(k) and a strategy meeting with me if you have not spoken to me in 6 months.

I have been liking the Value sector over the last 7 months, now the growth sector, is starting to look better for purchase.

Some of the INDEXES of the markets both equities and interest rates are below.

Dow Jones +13.63%

S&P 500 +13.88%

EQUAL WEIGHTED S&P 500 +19.87%

NASDAQ Aggressive growth +8.9%

Large Cap Value +15%

I Shares Russell 2000 ETF (IWM) Small cap +18%

Midcap stock funds +18.1%

International Index (MSCI – EAFE ex USA +11.7%

International Emerging Markets +7.4%

Financial stocks +28%

Energy stocks +47%

Healthcare Stocks +10%

Moderate Mutual Fund Investment Grade Bonds (AAA) Long duration -1.86%

High Yield Merrill Lynch High Yield Index +2.1%

Floating Rate Bond Funds +2.61%

Short Term Bond +.6%

Multi sector bond funds +1.9%

Gold -1.47%

10 year Bond Yield 1.47%

Moderate Fund +8%

Average Disruptor Fund Aggressive growth -5%

Classicalprinciples.com and Robert Genetskis Excerpts

Market Outlook

Stocks were mostly higher this past week. The S&P 500 gained 1% moving to a new all-time high. The Nasdaq and QQQs rose 3% to within a fraction of their all-time highs while the Dow was down slightly and small caps were mixed.

Overall, stocks continue to show strong upward momentum. At 4239, the S&P500 is 27% above its fundamental value. Stocks clearly are overvalued. In spite of this overvaluation, the outlook for the market remains positive. After a bit of tapering in March and April, the Fed purchased $125 billion in securities in May. The Fed’s policy last year has led to double-digit increases in spending and wages during the first half of this year.

As the Fed pumps a significant amount of money into the economy, the impact on financial markets is immediate. In spite of the market’s overvaluation, the odds still favor higher rather than lower stock prices. The flood of new money into the economy has also depressed interest rates. Although the Fed’s target rate remains 0%, US interest rates are higher than in Europe and Japan. Foreign investors are ignoring US inflation and seeking out higher relative interest rates. This provides still another force driving interest rates temporarily lower.

As a result, rates for longer-term bonds have moved sharply lower. The Fed is settling up both the economy and financial markets for a dramatic and damaging correction.

For now, since the Fed insists on refilling a punch bowl that is already overflowing, all we can do is—Party on! A Look Back The explosive increases in consumer prices for May brought year-over-year inflation to 5% for the total index and 4% after eliminating food and energy prices. This was the highest yearly inflation in over a decade.

Stock Valuation: S&P 500 27% Overvalued

Economic Fundamentals: Positive

Monetary Policy; Highly Expansive

.

Source: Classical Principles.com

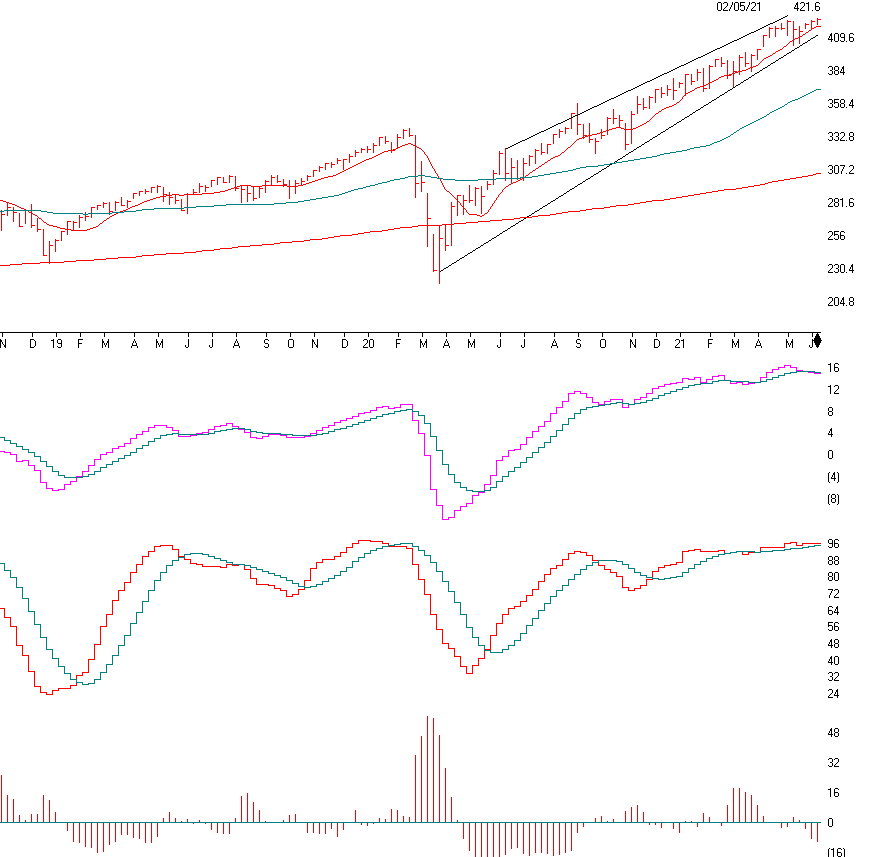

Above is the S&P 500, the long-term WEEKLY chart is shown. You can see the upward channel on the chart. AIQ is giving a SELL signal that I not confirmed but is flashing Sell signals. I do not want it to break 410 on a close. Because this channel has been a long-term Bullish channel since the bottom of the market last March. I am keeping my eyes on the 410 area of the SPY or about the 4100 level on the S&P. This is long term support, but remember, it is rising weekly, so next week it goes to 414 on the Spy, etc,

The Momentum chart is next. This market is extended, and I do not want to see the pink line break the blue line. That would be negative.

The next graph is the SK-SD Stochastics graph. It shows when the market is very over bought. Anything over 88 is overbought and it is at 96. When the red breaks the green line, it is on a sell. It is almost there.

The bottom chart is volume. When the market is going up you want it to go up on heavy volume. The volume is actually sub normal, another negative sign.

So what am I saying? I am saying that even though I am still Bullish long term, there are storm clouds out there. Watch the trend line break of 410 to 415 to see if it holds or not as there may be trouble. Not yet, but it is a Watch for the reduce.

Source: AIQsystems.com

Support levels on the S&P 500 area are 4100, 3700 3070. These may be safer areas to get into the equity markets on support levels slowly on the accumulation areas.

THE BOTTOM LINE:

I am still relatively Bullish on the market, but as you can see above, the market is getting overvalued. My target of 4400 on the S&P 500 is quickly approaching. The Value sector of the market and the mid and large value sectors are now fairly valued. Over the longer-term, technology, up about 8.90% should perform the best. Keep a disciplined approach to investing and do not chase the performers, you may get hurt. I like inflationary protection investments for a percentage of money.

Joe Bartosiewicz, CFP®

92 High Street

Thomaston, CT 06787 and

7501 East MCDowell RD

7501 East McDowll Rd #2172 Scottsdale, AZ 85257

Securities and advisory services offered through SagePoint Financial, Inc. (SPF), member FINRA/SIPC. SPF is separately owned and other entities and/or marketing names, products or services referenced here are independent of SPF. 800-552-3319 20 East Thomas Road Ste 2000 Phoenix AZ 85012

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30-50% of its portfolio in different categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment-grade rating. The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating-rate coupon U.S. Treasuries, which have a maturity greater than 12 months.