In der dynamischen Welt des Handels ist es entscheidend, mit innovativen Tools ausgestattet zu sein, die Händlern helfen, fundierte Entscheidungen zu treffen. Die neuen Charting-Features, die heute verfügbar sind, bieten eine Vielzahl von Möglichkeiten, die den Handelsprozess erheblich erleichtern und optimieren. In diesem Artikel werden einige herausragende Funktionen von Charting-Tools untersucht, die speziell für erfahrene Trader entwickelt wurden.

Benutzerfreundliche Oberfläche für maximale Effizienz

Die zunehmende Komplexität des Marktes erfordert eine benutzerfreundliche Bedienoberfläche, die es auch weniger erfahrenen Händlern ermöglicht, effektiv zu navigieren. Hier sind einige der Vorteile, die eine intuitive Benutzeroberfläche bietet:

- Schneller Zugang zu wesentlichen Funktionen: Mit einem klaren Dashboard können Trader schnell auf die benötigten Werkzeuge zugreifen.

- Benutzerdefinierte Einstellungen: Die Möglichkeit, Layouts nach eigenen Vorlieben anzupassen.

- Interaktive Charts: Mit Grafiken, die sich leicht anpassen lassen, wird die Analyse einfacher und übersichtlicher.

Die Kraft der Indikatoren: Sofortige Marktanalysen

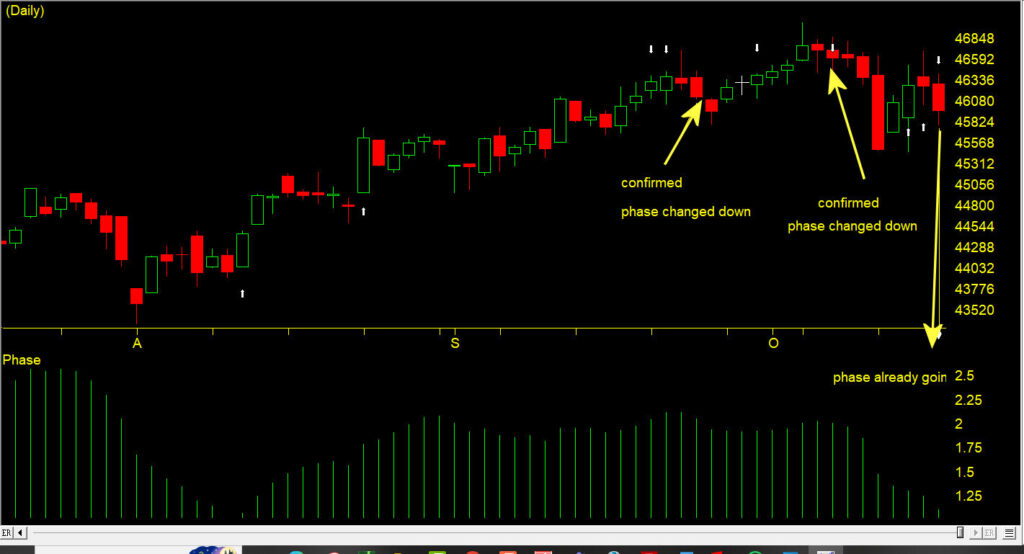

Indikatoren spielen eine entscheidende Rolle bei der technischen Analyse. Sie helfen Händlern, die Marktbedingungen schnell zu bewerten. Durch eine effektive Anzeige dieser Indikatoren erhalten Trader sofortige Einblicke in:

Unsere Leser könnten Wert darin finden, https://afs-duesseldorf.de/ zu besuchen, um weitere Informationen zu erhalten und sich inspirieren zu lassen.

- Marktrichtung: Schnell erkennen, ob sich ein Trend entwickelt.

- Volatilität: Schwankungen im Markt können frühzeitig identifiziert werden.

- Beliebtheit von Aktientiteln: Indikatoren helfen, Trends in bestimmten Sektoren zu erkennen.

Effiziente Suchfunktionen für jeden Trader

Durchsuchen von Listen und Industriegruppen sollte einfach und effizient sein. Mit fortschrittlichen Suchfunktionen können Trader:

- Schnell zwischen verschiedenen Märkten wechseln: Einfache Navigation durch tickende Listen.

- Flexibles Verwalten von Watchlists: Aktive Überwachung von preissensitiven Aktien auf einen Blick.

- Marktforschung mit Leichtigkeit betreiben: Informierte Entscheidungen basierend auf umfangreichen Analysen treffen.

Individuelle Indikatoren für maßgeschneiderte Strategien

Ein weiterer Vorteil moderner Charting-Tools ist die Möglichkeit, individuelle Indikatoren zu erstellen. Dies ermöglicht es Händlern, ihre eigenen Handelsstrategien klar zu definieren und diese mit spezifischen Indikatoren zu unterstützen. Die Vorteile beinhalten:

- Individualisierung: Schaffung von Indikatoren, die auf spezifische Handelstaktiken zugeschnitten sind.

- Zugänglichkeit: Einfache Erstellung und Implementierung in bestehende Charts.

- Erweiterte Analyse: Verfeinerte Handelsentscheidungen durch persönliche Datenanalyse.

Fazit: Die Bedeutung fortschrittlicher Charting-Funktionen

In einer Zeit, in der Information der Schlüssel zum Erfolg ist, können fortschrittliche Charting-Funktionen den entscheidenden Vorteil im Handel bieten. Die Kombination aus benutzerfreundlichen Oberflächen, leistungsstarken Indikatoren und individuellen Anpassungsmöglichkeiten ermöglicht es Händlern, strategische Entscheidungen zu treffen, die auf präzisen Analysen basieren. Investieren Sie in Ihre Handelswerkzeuge – die Zukunft gehört den gut informierten Händlern!