The AIQ code based on Ken Calhoun’s article in April 2016 issue of Stock & Commodities Trading Gap Reversals”, is provided below.

AIQ has also posted the EDS file at “ is provided for downloading at

Save this file to your/wintes32/EDS Strategies folder.

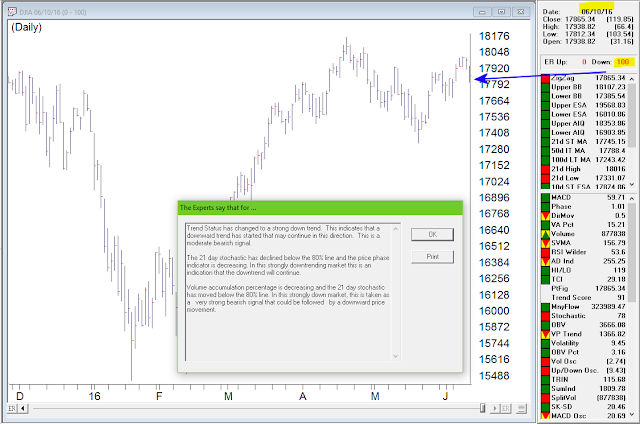

Since I mainly work with daily bar strategies, I wanted to test the gap-down concept on a daily bar trading system rather than on one-minute bars. I set up a system that buys after a stock has gapped down at least 10% in the last two days and then trades above the high of the gap-down bar. The entry is then at the close of that bar. For exits, I used the built-in exit, the profit-protect exit set at 80% once profit reaches 3% or more combined with a stop-loss using the low of the gap-down bar and also a time exit set to five bars.

I then ran this system on the NASDAQ 100 list of stocks in the EDS backtester over the period 12/31/1999 to 1/11/2016 (Figure 7). The system generated 303 trades with an average profit of 1.09% per trade with a reward-to-risk ratio of 1.35. Slippage and commissions have not been deducted from these results.

FIGURE 7: AIQ. This shows the EDS test results for the example system.

Again, the code and EDS file can be downloaded from www.TradersEdgeSystems.com/traderstips.htm, and is also shown below.

!TRADING GAP REVERSALS

!Author: Ken Calhoun, TASC April 2016

!Coded by: Richard Denning 2/1/2016

!www.TradersEdgeSystems.com

!INPUTS:

GapSize is 10.

GapLookBack is 5.

MaxBars is 5.

!CODING ABBREVIATIONS:

H is [high].

C is [close].

C1 is val([close],1).

L is [low].

O is [open].

GapD is (O / C1 - 1) * 100.

GapOS is scanany(GapD < -GapSize,GapLookBack) <> nodate()

then offsettodate(month(),day(),year()).

Hgap is valresult(H,^GapOS).

Lgap is valresult(L,^GapOS).

SU if scanany(GapD < -GapSize,GapLookBack).

SU1 if scanany(GapD < -GapSize,GapLookBack,1).

SU2 if scanany(GapD < -GapSize,GapLookBack,2).

LE if ((SU1 then resetdate()) or (SU2 then resetdate()))

and H > Hgap.

ExitLong if {position days} > maxBars

or C < Lgap.

EntryPr is max(O,Hgap).

List if C > 0.

—Richard Denning