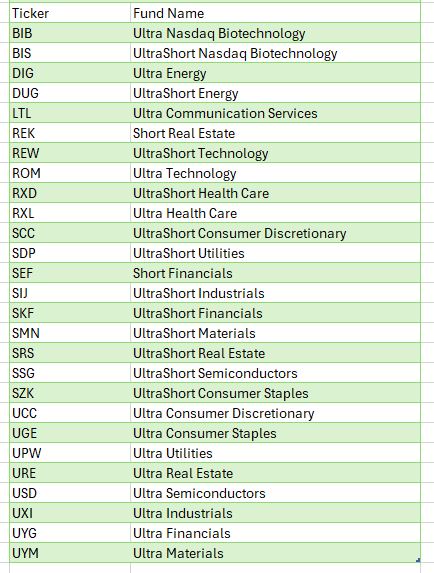

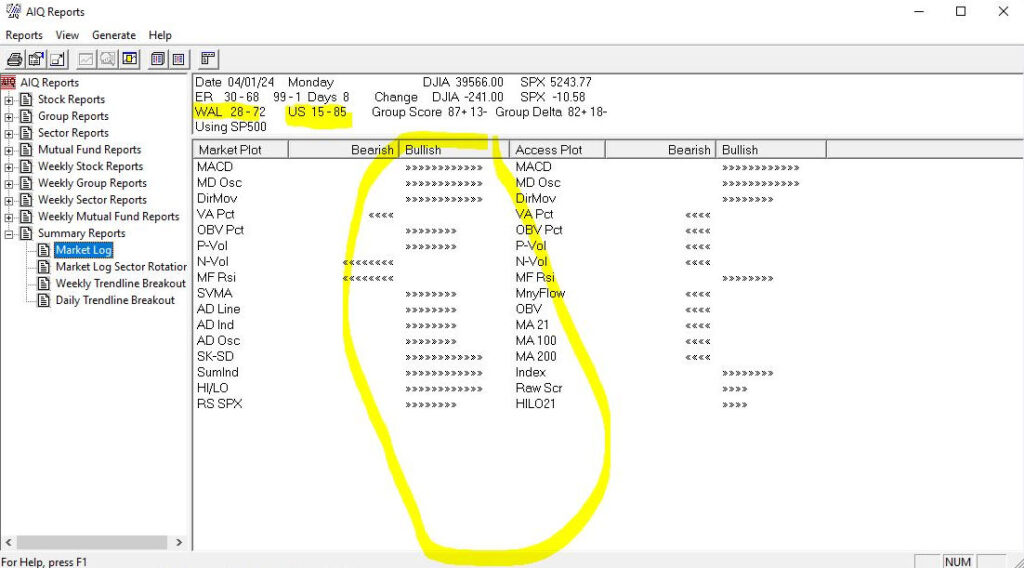

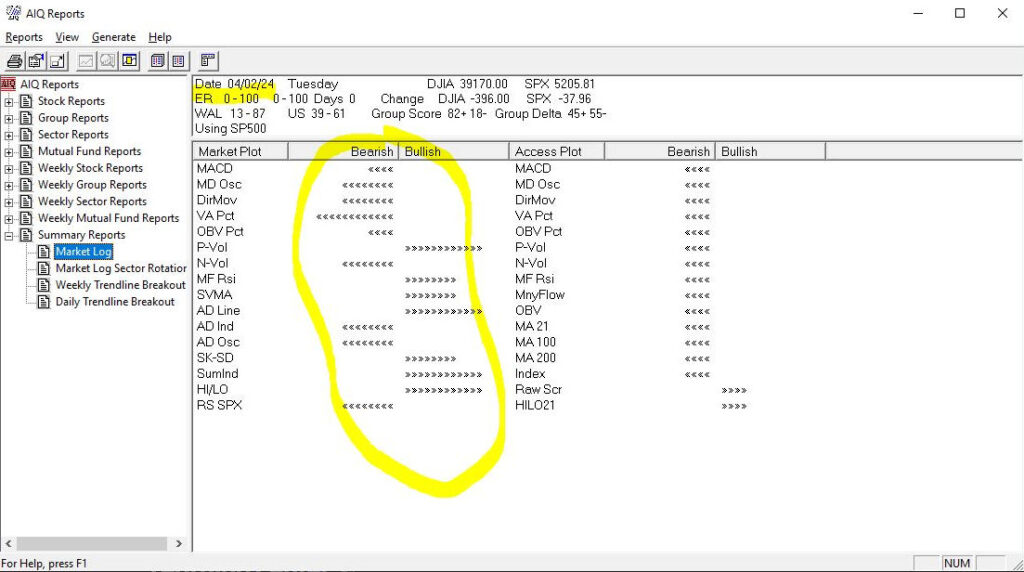

Recording of the Zoom meet from 5-17-24 is now available. During this meeting Steve Hill, CEO of AIQ Systems discussed using Reports, and Expert Design Studio strategies to trade ETFs. The Direxion ETFs and a list of the 100 most traded ETFs were used to evaluate the strategies. The Boomer Buy and Denning VCR strategies were tested and are also available to download. The Relative Strength rotation EDS file is also available.

ETF list files discussed in this video are available for download below. Please save these to your /wintes32 folder.

https://aiqeducation.com/downloads/DIREXION.lis The full list of Direxion ETFs.

https://aiqeducation.com/downloads/DX2XETFS.lis The 2x leverage Direxioin ETFs.

https://aiqeducation.com/downloads/DXFIXED.lis The Fixed Income ETFs.

https://aiqeducation.com/downloads/DXINTEQ.lis The International Equity ETFs.

https://aiqeducation.com/downloads/DXMKTCAP.lis US Market ETFs.

https://aiqeducation.com/downloads/DXSECTOR.lis US Sector ETFs.

https://aiqeducation.com/downloads/DXSSTOCK.lis US Stock ETFs.

https://aiqeducation.com/downloads/ETFS100.lis Top Volume ETFs.

https://aiqeducation.com/downloads/ETF-SECT.lis Sector Rotation ETFs.

Expert Design Studio files discussed in this video. Download and save these to your /wintes32/EDS Strategies folder.

https://aiqeducation.com/downloads/Boomer%20Buy.EDS Boomer Buy strategy for ETFs. https://aiqeducation.com/downloads/Boomer%20Buy%20BoomerBuy3.edp Backtest for Boomer Buy.

https://aiqeducation.com/downloads/DenningVCR2.EDS Denning VCR strategy for ETFs. https://aiqeducation.com/downloads/DenningVCR2%20GoLong.edp Backtest for Denning VCR .

https://aiqeducation.com/downloads/RStradingforETFs%20%281%29.EDS Relative Strength Rotation for Sector ETFs.

#stocktrading #etftrading #technicalanalysis