ChartSmart

ChartSmart

Transform raw chart data into actionable trading insights with the definitive guide to 29 essential technical indicators

Limited Time Offer - Save $40!

Why ChartSmart?

29 Essential Indicators

Master every indicator from Moving Averages to Bollinger Bands, MACD to Stochastics - all explained in plain English.

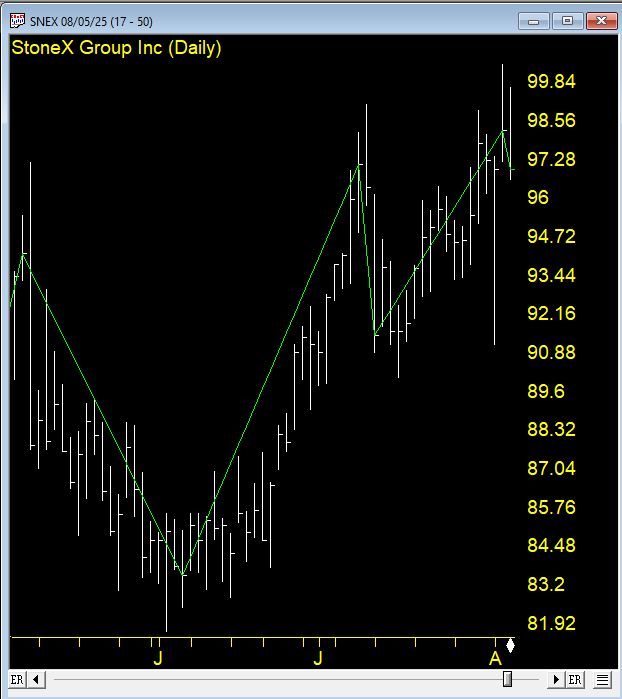

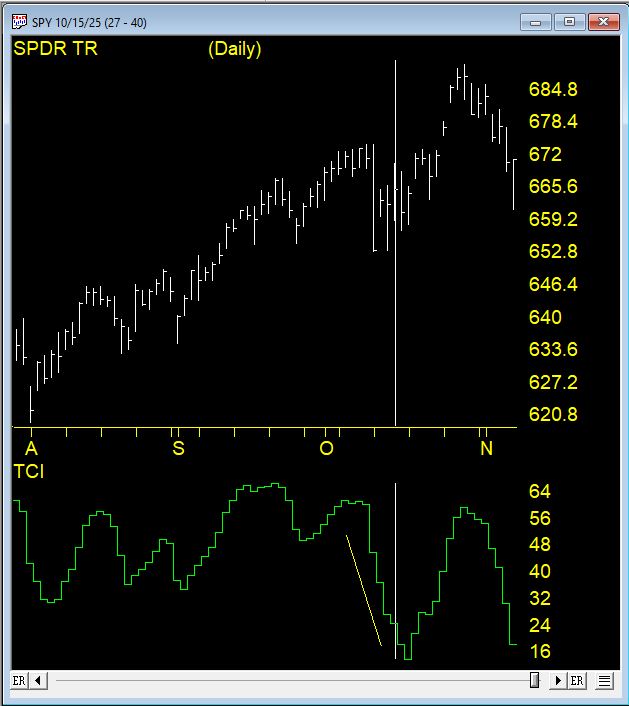

Real Market Examples

40+ recent chart examples from 2025 showing exactly how each indicator performs in actual market conditions.

Actionable Strategies

Learn when to buy, when to sell, and how to combine indicators for stronger confirmation signals.

Optimal Settings

Generally accepted input values and parameter ranges for each indicator to get started quickly.

Avoid Common Errors

Learn the interpretation mistakes that cost traders money - and how to avoid them.

Trading Platform Ready

Apply these strategies across many trading platform with examples you can implement immediately.

Learn Proven Strategies

Master these powerful indicator combinations used by professional traders

Stochastic Oscillator - Overbought/Oversold Signals

Buy Signal: When Stochastic crosses above 20 from below (oversold zone), especially if accompanied by bullish price action.

Sell Signal: When Stochastic crosses below 80 from above (overbought zone), particularly when price shows weakness.

MACD - Trend Following & Divergence

Buy Signal: MACD line crosses above signal line while both are below zero, or bullish divergence (price makes lower low, MACD makes higher low).

Sell Signal: MACD line crosses below signal line while both are above zero, or bearish divergence (price makes higher high, MACD makes lower high).

Volume + Price Action - Confirmation Strategy

Buy Signal: Volume spike on price breakout above resistance—shows institutional accumulation and confirms the move.

Sell Signal: High volume on breakdown below support, or declining volume during rally (distribution phase).

Combining Stochastic + MACD - Power Setup

Buy Signal: Stochastic crosses above 20 (oversold) AND MACD crosses above signal line within 1-3 bars of each other.

Sell Signal: Stochastic crosses below 80 (overbought) AND MACD crosses below signal line within 1-3 bars.

Bollinger Bands - Volatility Breakouts

Buy Signal: Price touches lower band, then closes back inside with increasing volume. Or "squeeze" (bands tighten) followed by breakout above upper band.

Sell Signal: Price touches upper band, then closes back inside with volume. Or breakdown below lower band after squeeze.

ZigZag - Identifying Swing Points

Buy Signal: ZigZag identifies higher swing lows in an uptrend. Buy near the new swing low with stop below the previous swing low.

Sell Signal: ZigZag shows lower swing highs in a downtrend. Sell near the new swing high with stop above the previous swing high.

Real chart examples from stocks like GOOGL, TSLA, AAPL, and more - all from 2025 market conditions

See Real Indicators in Action

Learn to spot divergences and non-confirmations that signal reversals

Understand consolidation patterns and volatility squeezes that precede big moves

Combine multiple indicators for high-probability entry and exit points

Replace intuition with insight backed by proven technical analysis

Every Indicator You Need

21-Day High/Low

21-Day High/Low Accumulation/Distribution

Accumulation/Distribution Advance/Decline Indicators

Advance/Decline Indicators ADX & ADX Rate

ADX & ADX Rate Bollinger Bands

Bollinger Bands Commodity Channel Index

Commodity Channel Index Exponential Moving Averages

Exponential Moving Averages Moving Averages (Simple)

Moving Averages (Simple) MACD

MACD Parabolic SAR

Parabolic SAR Stochastics (SK-SD)

Stochastics (SK-SD) Volume Indicators

Volume Indicators Trading Bands

Trading Bands Volume Oscillator

Volume Oscillator Velocity

Velocity Volatility Indicator

Volatility Indicator ZigZag

ZigZagStart Trading Smarter Today

Join traders who've transformed their approach with ChartSmart

Holiday Sale - Ends Soon!