Suddenly everyone is once again singing the praises of long-term treasuries. And on the face of it, why not? With interest rates seemingly headed to negative whatever, a pure play on interest rates (with “no credit risk” – which I still find ironic since t-bonds are issued by essentially the most heavily indebted entity in history – the U.S. government) stands to perform pretty darn well.

EDITORS NOTE: We combined Jay's 2 articles on Beating the Bond Market into one article. Later in the article Jay uses AIQ TradingExpert Matchmaker tool to reveal that convertible bonds and high yield corporates have a much higher correlation to the stock market than they do to the long-term treasury.

But is it really the best play?

Long-Term Treasuries vs. “Others”

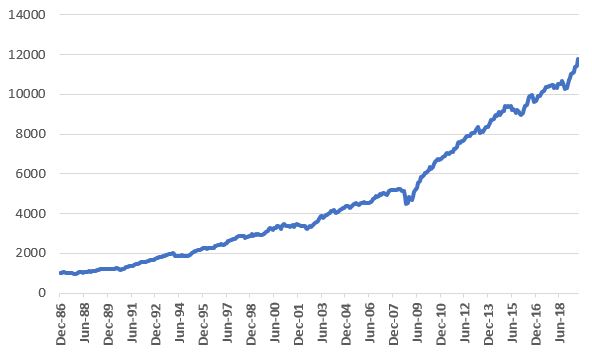

Because a later test will use the Bloomberg Barclays Convertible Bond Index, and because that index starts in 1986 and because I want to compare “apples” to “apples”, Figure 1 displays the growth of $1,000 since 1986 using monthly total return data for the Bloomberg Barclays Treasury Long Index.

Figure 1 – Growth of $1,000 in Long-Term Treasuries (1987-2019)

For the record:

| Ave. 12 mo % | +8.2% |

| Std. Deviation | +9.0% |

| Max Drawdown | (-15.9%) |

| $1,000 becomes | $12,583 |

Figure 2 – Bloomberg Barclays Treasury Long Index (Jan 1987-Jul 2019)

Not bad, apparently – if your focus is return and you don’t mind some volatility and you have no fear of interest rates ever rising again.

A Broader Approach

Now let’s consider an approach that puts 25% into the four bond indexes below and rebalances every Jan. 1:

*Bloomberg Barclay’s Convertible Bond Index

*Bloomberg Barclays High Yield Very Liquid Index

*Bloomberg Barclays Treasury Long Index

*Bloomberg Barclay’s Intermediate Index

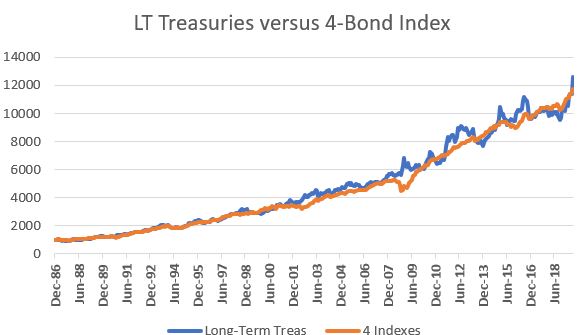

Figure 3 displays the growth of this “index” versus buying and holding long-term treasuries.

Figure 3 – Growth of $1,000 invested in 4-Bond Indexes and rebalanced annually; 1987-2019

| Ave. 12 mo % | +8.0% |

| Std. Deviation | +6.8% |

| Max Drawdown | (-14.8%) |

| $1,000 becomes | $11,774 |

Figure 4 – 4-Bond Index Results; 1987-2019

As you can see, the 4-index approach:

*Is less volatile in nature (6.8% standard deviation versus 9.0% for long bonds)

*Had a slightly lower maximum drawdown

*And has generated almost as much gain as long-term treasuries alone (it actually had a slight lead over long-term treasuries prior to the rare +10% spurt in long treasuries in August 2019)

To get a better sense of the comparison, Figure 5 overlays Figures 1 and 3.

Figure 5 – Long Treasuries vs. 4-Bond Index

As you can see in Figure 5, in light of a long-term bull market for bonds, at times long-term treasuries have led and at other times they have trailed our 4-Bond Index. After the huge August 2019 spike for long-term treasuries, they are back in the lead. But for now, the point is that the 4-Bond Index performs roughly as well with a great deal less volatility.

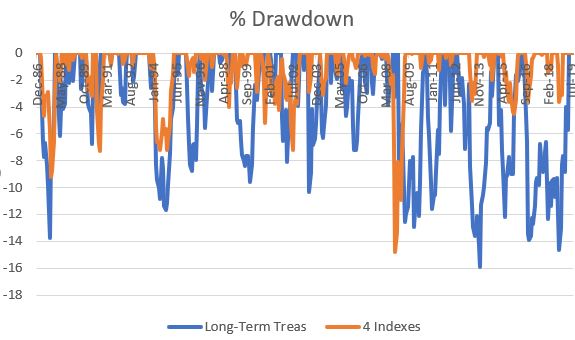

To emphasize this (in a possibly slightly confusing kind of way), Figure 6 shows the drawdowns for long treasuries in blue and drawdowns for the 4-Bond Index in orange. While the orange line did have one severe “spike” down (during the financial panic of 2008), clearly when trouble hits the bond market, long-term treasuries tend to decline more than the 4-Bond Index.

Figure 6 – % Drawdowns for Long-term treasuries (blue) versus 4-Bond Index (orange); 1987-2019

Summary

Long-term treasuries are the “purest interest rate play” available. If rates fall then long-term treasuries will typically outperform most other types of bonds. On the flip side, if interest rates rise long-term treasuries will typically underperform most other types of bonds.

Is this 4-index approach the “be all, end all” of bond investing? Is it even superior to the simpler approach of just holding long-term bonds?

Not necessarily. But there appears to be a better way to use these four indexes – which I will get to below

So, all-in-all the 4-bond index seems like a “nice alternative” to holding long-term treasuries. But the title of these articles says “Beating the Bond Market” and not “Interesting Alternatives that do Just about as Well as Long-Term Treasuries” (which – let’s face it – would NOT be a very compelling title). So, let’s dig a little deeper. In order to dig a little deeper, we must first “go off on a little tangent.”

Bonds versus Stocks

In a nutshell, individual convertible bonds and high yield corporate bonds are tied to the fortunes of the companies that issue them. This also means that as an asset class, their performance is tied to the economy and the business environment in general. If times are tough for corporations it only makes sense that convertible bonds and high yield bonds will also have a tougher time of it. As such it is important to note that convertible bonds and high yield corporates have a much higher correlation to the stock market than they do to the long-term treasury.

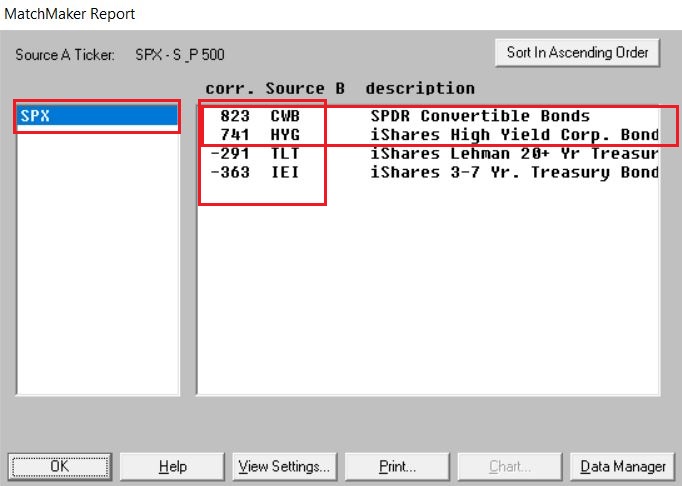

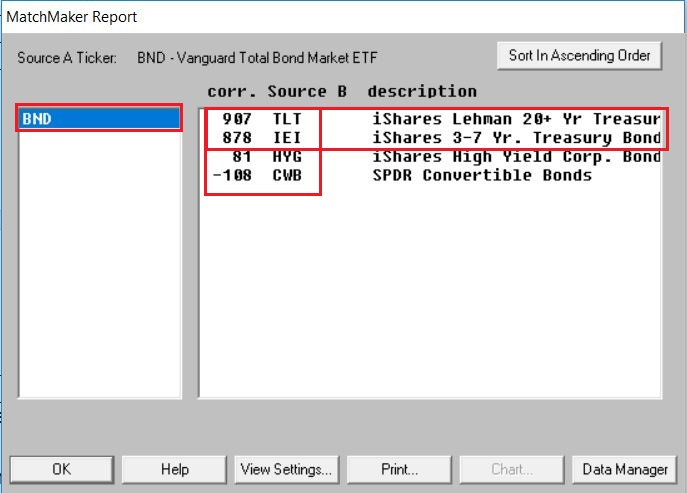

In Figures 1 and 2 we use the following ETF tickers:

CWB – as a proxy for convertible bonds

HYG – As a proxy for high-yield corporates

TLT – As a proxy for long-term treasuries

IEI – As a proxy for short-term treasuries

SPX – As a proxy for the overall stock market

BND – As a proxy for the overall bond market

As you can see in Figure 1, convertible bonds (CWB) and high-yield corporates (HYG) have a much higher correlation to the stock market (SPX) than to the bond market (BND).

Figure 1 – 4-Bond Index Components correlation to the S&P 500 Index (Courtesy AIQ TradingExpert)

As you can see in Figure 2, long-term treasuries (TLT) and intermediate-term treasuries (IEI) have a much higher correlation to the bond market (BND) than to the stock market (SPX).

Figure 2 – 4-Bond Index Components correlation to Vanguard Total Bond Market ETF (Courtesy AIQ TradingExpert)

A Slight Detour

Figure 3 displays the cumulative price change for the S&P 500 Index during the months of November through April starting in 1949 (+8,881%)

Figure 3 – Cumulative % price gain for S&P 500 Index during November through April (+8,881%); 1949-2019

Figure 4 displays the cumulative price change for the S&P 500 Index during the months of June through October starting in 1949 (+91%)

Figure 4 – Cumulative % price gain for S&P 500 Index during June through October (+91%); 1949-2019

The Theory: Parts 1 and 2

Part 1: The stock market performs better during November through April than during May through October

Part 2: Convertible bonds and high-grade corporate bonds are more highly correlated to stocks than long and intermediate-term treasuries

Therefore, we can hypothesize that over time convertible and high-yield bonds will perform better during November through April and that long and intermediate-term treasuries will perform better during May through October.

Jay’s Seasonal Bond System

During the months of November through April we will hold:

*Bloomberg Barclay’s Convertible Bond Index

*Bloomberg Barclays High Yield Very Liquid Index

During the months of May through October we will hold:

*Bloomberg Barclays Treasury Long Index

*Bloomberg Barclay’s Intermediate Index

(NOTE: While this article constitutes a “hypothetical test” and not a trading recommendation, just to cover the bases, an investor could emulate this strategy by holding tickers CWB and HYG (or ticker JNK) November through April and tickers TLT and IEI May through October.)

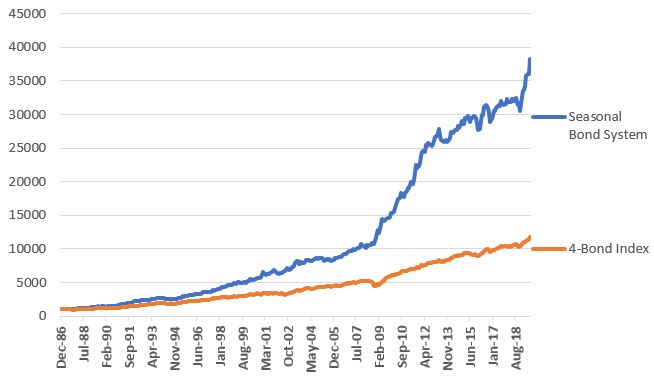

Figure 5 displays the growth of $1,000 invested using this Seasonal System (blue line) versus simply splitting money 25% into each index and then rebalancing on January 1st of each year (orange line).

Figure 5 – Growth of $1,000 invested using Jay’s Seasonal System versus Buying-and-Holding and rebalancing (1986-2019)

Figure 6 displays some comparative performance figures.

| Measure | Seasonal System | 4 Indexes Buy/Hold/Rebalance |

| Average 12 month % +(-) | +11.9% | +8.0% |

| Std. Deviation % | 8.7% | 6.8% |

| Ave/StdDev | 1.37 | 1.18 |

| Max Drawdown% | (-9.2%) | (-14.8%) |

| $1,000 becomes | $38,289 | $11,774 |

Figure 6 – Seasonal Strategy versus Buy/Hold/Rebalance

From 12/31/1986 through 8/31/2019 the Seasonal System gained +3,729% versus +1,077% (3.46 times as much) as the buy/hold and rebalance method.

Summary

The Seasonal Bond System has certain unique risks. Most notably if the stock market tanks between November 1 and April 30, this system has no “standard” bond positions to potentially offset some of the stock market related decline that convertible and high yield bonds would likely experience. Likewise, if interest rates rise between April 30 and October 31st, this strategy is almost certain to lose value during that period as it holds only interest-rate sensitive treasuries during that time.

The caveats above aside, the fact remains that over the past 3+ decades this hypothetical portfolio gained almost 3.5 times that of a buy-and-hold approach.

Question: Is this any way to trade the bond market?

Answer: Well, it’s one way….

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.